The Change

A report has been created to display exceptional payments being made employees based on custom criteria set at pay basis level. This report can be used highlight various circumstances that may require attention.

Release Date: 18-Sep-2014

Reason for the Change

This report was created to provide additional information when checking the final payroll information.

Customers Affected

This is available to all People System customers using the Payroll Module.

Release Notes

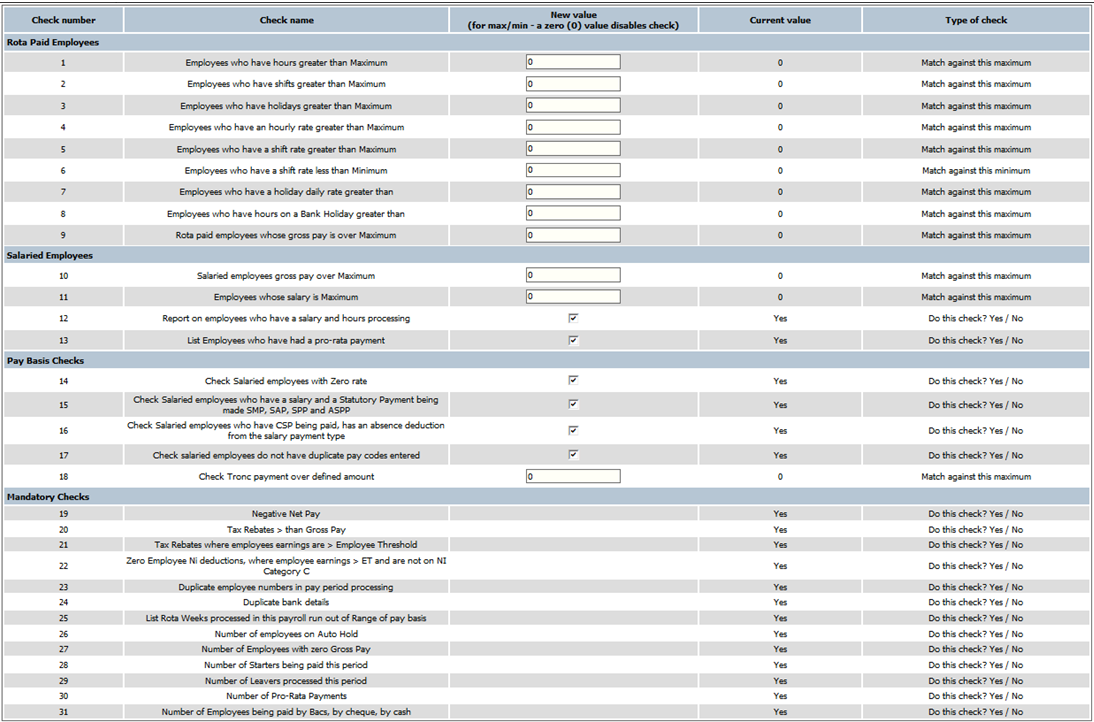

Fig 1 - Exceptions Configuration

- To use the exception report the user must first configure the exception checks.

- To do this, follow the path: Payroll > Administration > Company Setup > Select the Company > View Pay Bases > Select Pay Basis > Configure Exception Checks.

- Fig 1 above shows the screen exceptions maybe configured.

- From here the user can configure each check between numbers 1 to 18. Checks 19 to 31 are mandatory checks that the report will complete.

- The description of each table is shown below:

| # | Field Name | |

|---|---|---|

| 1 | “Employees who have hours greater than Maximum” | This will report employees who have hours greater than a number defined by the user. |

| 2 | “Employees who have shifts greater than Maximum” | This will report employees who have shifts greater than an amount defined by the user. |

| 3 | “Employees who have holidays greater than Maximum” | This will report employees who have holiday pay greater than an amount defined by the user. |

| 4 | “Employees who have an hourly rate greater than Maximum” | This will report employees who have an hourly rate greater than an amount defined by the user. |

| 5 | “Employees who have a shift rate greater than Minimum” | This will report employees who have a shift rate greater than an amount defined by the user. |

| 6 | “Employees who have a shift rate less than Minimum” | This will report employees who have a shift rate less than an amount defined by the user. |

| 7 | “Employees who have a holiday daily rate greater than” | This will report employees who have a holiday rate greater than an amount defined by the user. |

| 8 | “Employees who have hours on a Bank Holiday greater than” | This will report employees who have hours on a bank holiday greater than an amount defined by the user. |

| 9 | “Rota paid employees whose gross pay is over Maximum” | This will report rota paid employees who have a gross pay greater than an amount defined by the user. |

| 10 | “Salaried employees gross pay over Maximum” | This will report salaried paid employees who have a gross pay greater than an amount defined by the user. |

| 11 | “Employees whose salary is Maximum” | This will report employees who have a salary greater than an amount defined by the user. |

| 12 | “Report on employees who have a salary and hours processing” | This will report employees who have a salary as well as hours processing on the payroll. |

| 13 | “List Employees who have had a pro-rata payment” | This will report employees who have a pro-rata salary processing on the payroll. |

| 14 | “Check Salaried employees with Zero rate” | This will report employees who have a zero rate salary processing on the payroll. |

| 15 | “Check Salaried employees who have a salary and a Statutory Payment being made SMP, SAP, SPP and ASPP” | This will report employees who have a salary as well as a statutory payment processing on the payroll. |

| 16 | “Check Salaried employees who have CSP being paid, has an absence deduction from the salary payment type” | This will report employees who have a CSP payment and have an absence deduction from the salary payment. |

| 17 | “Check salaried employees do not have duplicate pay codes entered” | This will report employees who have 2 or more of the same payment type processing on the payroll. |

| 18 | “Check Tronc payment over defined amount” | This will report employees who have a tronc payment greater than an amount defined by the user. |

| 19 | “Negative Net Pay” | This will report employees who have a net pay amount less than £0.00. |

| 20 | “Tax Rebates > than Gross Pay” | This will report employees who have are receiving a tax refund greater than the gross pay. |

| 21 | “Tax Rebates where employees earnings are > Employee Threshold” | This will report employees who have are receiving a tax refund and have gross earnings higher than the PAYE threshold. The thresholds are located under the following path: Payroll > Administration > Company Setup > Select Company > Payroll Statutory Information. |

| 22 | “Zero Employee Ni deductions, where employee earnings > ET and are not on NI Category C” | This will report employees who have are not paying National Insurance, have gross earnings higher than the NI threshold, and are not on category C National Insurance. |

| 23 | “Duplicate employee numbers in pay period processing” | This will report instances of where there are 2 or more of the same employee number on the pay run. |

| 24 | “Duplicate bank details” | This will report instances of where there are 2 or more of the same employee bank details on the pay run. |

| 25 | “List Rota Weeks processed in this payroll run out of Range of pay basis” | This will highlight any payments that do not apply to the current pay period. |

| 26 | “Number of employees on Auto Hold” | This will report the number of employees that are on hold on the pay run. |

| 27 | “Number of Employees with zero Gross Pay” | This will report the number of employees that have zero net pay on the pay run. |

| 28 | “Number of Starters being paid this period” | This will report the number of new employees on the current pay run. |

| 29 | “Number of Leavers processed this period” | This will report the number of employees that are leavers on the current pay run. |

| 30 | “Number of Pro-Rata Payments” | This will report the number of employees that have pro-rata payments on the current pay run. |

| 31 | “Number of Employees being paid by BACS, by cheque, by cash” | This will report the number of employees on the current pay run that are being paid by BACS, cheque and cash. |

- Following the configuration stage the user will only need to re-visit this page to make amendments to the checks.

- To run the report first run a payroll preview, and then click the ‘Exception Report’ button shown in Fig 2 below.

Fig 2 - Exception Report Button

- When completed an excel file will be produced with the following column headers:

- Sequence – The number under this column relates to the check number detailed above.

- Check – This is the check description

- Header ID – This number will increase by 1 each time the payroll preview has been run.

- Employee Number

- Full Name

- Quantity – The checks that detail a number of employees it will show the count here.

- Maximum – This is the amount set when configuring the exception checks.

- Description

- Location – where individual employees are identified it will list the location the employee where works.

Comments

Please sign in to leave a comment.