What’s Changing?

The Employment Allowance settings within the Company Details page has been amended to accommodate the changes that are being introduced by HMRC in April 2020.

Release Date: 12th March 2020

Reason for Change

In April 2020, new rules around Employment Allowance and which companies are eligible will come into force.

Customers Affected

All HR & Payroll customers using the Payroll module.

Employment Allowance Reforms

From 6th April 2020, Employment Allowance will be restricted to Employers whose Employer NIC Contributions were less than £100,000 in the preceding year and, because of this restriction, Employment Allowance is now considered to be ‘de minimis state aid’.

The change means eligible companies that claim the de minimis state aid will need to monitor and reconcile the amount of aid claimed over a three-year period (including Employment Allowance) - the current and previous two years.

Each year, businesses will need to calculate their eligibility to claim Employment Allowance. It will not automatically carry over across the tax years.

To ensure all customers are reviewing their entitlement to Employment Allowance, the Claim Employment Allowance tick will be automatically removed from the checkbox when the Portal is rolled forward into the new tax year.

Release Notes

Following the introduction of new legislation, changes have been made to the Employment Allowance functionality so that Eligible Businesses can claim the £4000 allowance and report to HMRC Correctly.

When the box is ticked, a pop-up window will appear giving details about the changes to Employment Allowance – see Fig 2.

There are four industries to select from, as shown in Fig.3.

To make a claim of ‘de minimis state aid’, a company must declare which industry they operate within. The drop-down will default to Industrial Sector.

Once saved, the screen will show as per Fig.4.

Reporting to HMRC

The Employment Allowance reforms mean that more information is required to be sent to HMRC via the Employment Payment Submission (EPS).

Previously, only the amount of Employment Allowance claimed was reported, if applicable. The EPS has been changed to include the following detail (see Fig.5). All data fields will update automatically and will be submitted via the EPS as part of the normal, monthly submission.

The Employment Allowance settings within the Company Details page has been amended to accommodate the changes that are being introduced by HMRC in April 2020.

Release Date: 12th March 2020

Reason for Change

In April 2020, new rules around Employment Allowance and which companies are eligible will come into force.

Customers Affected

All HR & Payroll customers using the Payroll module.

Employment Allowance Reforms

From 6th April 2020, Employment Allowance will be restricted to Employers whose Employer NIC Contributions were less than £100,000 in the preceding year and, because of this restriction, Employment Allowance is now considered to be ‘de minimis state aid’.

The change means eligible companies that claim the de minimis state aid will need to monitor and reconcile the amount of aid claimed over a three-year period (including Employment Allowance) - the current and previous two years.

Each year, businesses will need to calculate their eligibility to claim Employment Allowance. It will not automatically carry over across the tax years.

To ensure all customers are reviewing their entitlement to Employment Allowance, the Claim Employment Allowance tick will be automatically removed from the checkbox when the Portal is rolled forward into the new tax year.

Release Notes

Following the introduction of new legislation, changes have been made to the Employment Allowance functionality so that Eligible Businesses can claim the £4000 allowance and report to HMRC Correctly.

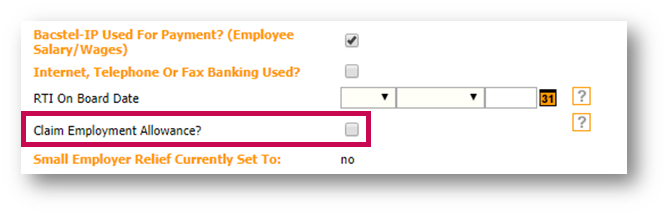

- To switch on Employment Allowance, go to Payroll > Administration > Company Setup and select the relevant Company

- Select Edit in the top-right corner of the page

Fig.1 - Claim Employment Allowance? tickbox on the Edit Company Details page

- Tick the box against Claim Employment Allowance?

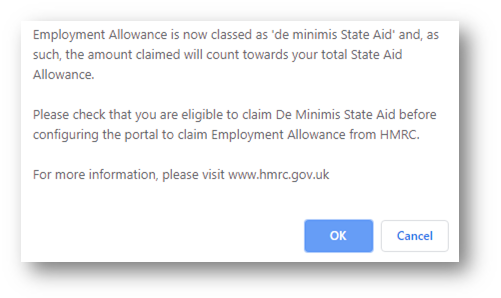

When the box is ticked, a pop-up window will appear giving details about the changes to Employment Allowance – see Fig 2.

Fig.2 - Employment Allowance Information pop-up window

- To cancel the setup of Employment Allowance, select Cancel

- To continue configuring the Employment Allowance claim, select OK

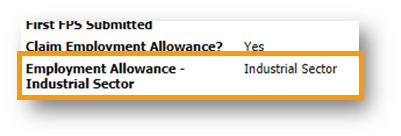

There are four industries to select from, as shown in Fig.3.

Fig.3 - Industrial sector option drop-down

To make a claim of ‘de minimis state aid’, a company must declare which industry they operate within. The drop-down will default to Industrial Sector.

- If a different sector is required, make the selection from the drop-down box

- Select Save

Once saved, the screen will show as per Fig.4.

Fig.4 - Employment Allowance Industrial Sector setting on the Company Details page

Reporting to HMRC

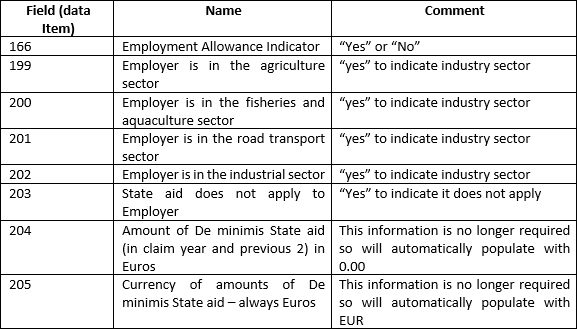

The Employment Allowance reforms mean that more information is required to be sent to HMRC via the Employment Payment Submission (EPS).

Previously, only the amount of Employment Allowance claimed was reported, if applicable. The EPS has been changed to include the following detail (see Fig.5). All data fields will update automatically and will be submitted via the EPS as part of the normal, monthly submission.

Fig.5 - New EPS Fields

Comments

Please sign in to leave a comment.