Following an announcement by the UK Government on 17th March 2020, the decision has been made to postpone the introduction of IR35 rules into the Private Sector until 6th April 2021.

What’s Changing?

Addition of new functionality to allow the processing of workers who fall within IR35 regulations through the payroll.

Release Date: 12th March 2020

Reason for the Change

With the introduction of new legislation for Private Sector Companies, the system must provide functionality that allows customers to process the tax and national insurance calculations for workers who are deemed to fall within the IR35 regulations.

Customers Affected

All HR & Payroll customers using the Payroll module.

Please Note: Customers are responsible for assessing whether their contractors fall within IR35 regulations.

Release Notes

The functionality introduced has added restrictions and validations to various sections of the HR and Payroll modules to enable the processing of tax and National Insurance contributions for workers who fall within IR35 regulations.

User Access

A new option within User Access has been added to portals, which will need to be added to users' permissions for them to be able to create IR35 employees.

To update access for individuals:

To update a Permissions Template:

Job Titles Creation

A new flag has been added to a Job Title so that Users can assign them exclusively to IR35 workers.

Once configured, this job title can only be assigned to employees attached to the IR35 pay basis. Existing job titles will not be able to be updated as an IR35 Job title.

When accessing an existing job title, the IR35 option will display but will be greyed out – see Fig.3.

Pay Basis Creation

A new flag has been added to the Pay Basis screen so that a pay basis can be assigned to IR35 payrolls.

Once flagged, only employees assigned to an IR35 job title can be assigned to this pay basis.

Payment Type Creation

There has been a flag added to the Payment Type Creation screen so that payments made to contractors that fall within OR35 regulations can be identified and reported on.

Employee Creation

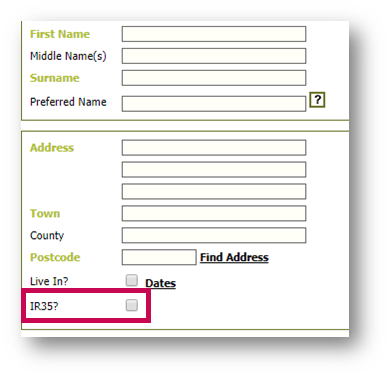

A new flag has been added to the Employee Personal Details page which allows an employee to be flagged as a contractor who falls within IR35 regulations.

Once flagged, the page has added validation which makes a number of fields that would usually be mandatory, non-mandatory, so the creation process can be completed without the requirement of adding data which would not usually be collected for contractors.

When the IR35? flag is ticked, the following fields, which would normally be mandatory, become hidden:

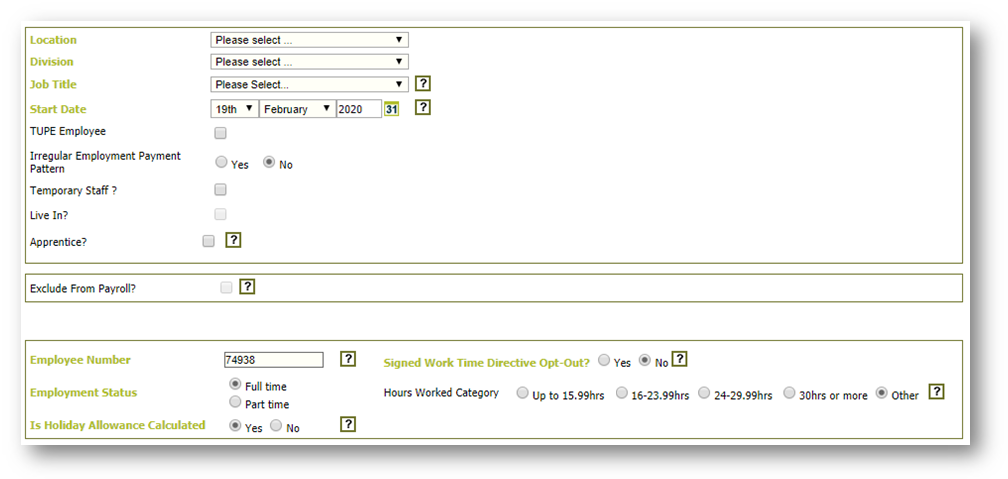

When going to the Employment Details page, the following details will would normally be mandatory for employees, will be hidden:

Rehire Employee

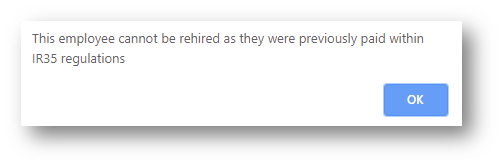

If an employee is flagged as IR35 in their Personal Details page, they will not be able to be rehired.

When an IR35 employee is selected for rehire, the message as shown in Fig.9 will appear.

What’s Changing?

Addition of new functionality to allow the processing of workers who fall within IR35 regulations through the payroll.

Release Date: 12th March 2020

Reason for the Change

With the introduction of new legislation for Private Sector Companies, the system must provide functionality that allows customers to process the tax and national insurance calculations for workers who are deemed to fall within the IR35 regulations.

Customers Affected

All HR & Payroll customers using the Payroll module.

Please Note: Customers are responsible for assessing whether their contractors fall within IR35 regulations.

Release Notes

The functionality introduced has added restrictions and validations to various sections of the HR and Payroll modules to enable the processing of tax and National Insurance contributions for workers who fall within IR35 regulations.

User Access

A new option within User Access has been added to portals, which will need to be added to users' permissions for them to be able to create IR35 employees.

To update access for individuals:

- Go to Payroll > Users > Assign User Access

- Select an Employee and go to their User Profile

- Enable the permission by ticking Create IR35 Employees

- Then select Next (possibly multiple times) unti returning to the User Profile page, where the updated setting will display

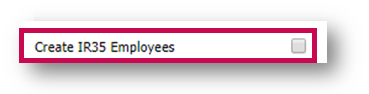

Fig.1 – IR 35 Assign User Permission

To update a Permissions Template:

- Go to Payroll > Users > Templates

- Select Template > Assign Permissions

- Enable the permission by ticking Create IR35 Employees

- Scroll down and select Save

Job Titles Creation

A new flag has been added to a Job Title so that Users can assign them exclusively to IR35 workers.

- Go to HR Module > Company Admin > Job Titles

- Select Create Job Title

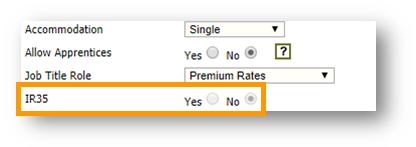

- Select Yes against IR35

- Select Save

Fig.2 - New Job Title Screen

Once configured, this job title can only be assigned to employees attached to the IR35 pay basis. Existing job titles will not be able to be updated as an IR35 Job title.

When accessing an existing job title, the IR35 option will display but will be greyed out – see Fig.3.

Fig.3 - IR35 setting greyed out for an existing Job Title

Pay Basis Creation

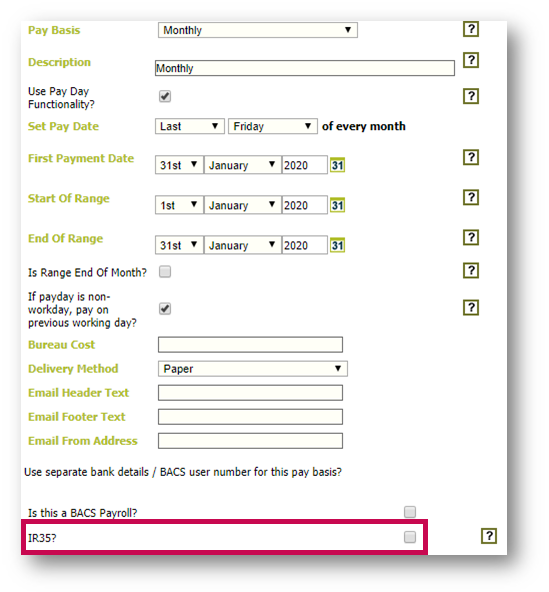

A new flag has been added to the Pay Basis screen so that a pay basis can be assigned to IR35 payrolls.

- Go to Payroll Module > Administration > Company Setup

- Select the Company and then View Pay Basis > Create New Pay Basis

- Tick the IR35? box

- Select Save

Fig.4 – Pay Basis Screen

Once flagged, only employees assigned to an IR35 job title can be assigned to this pay basis.

Payment Type Creation

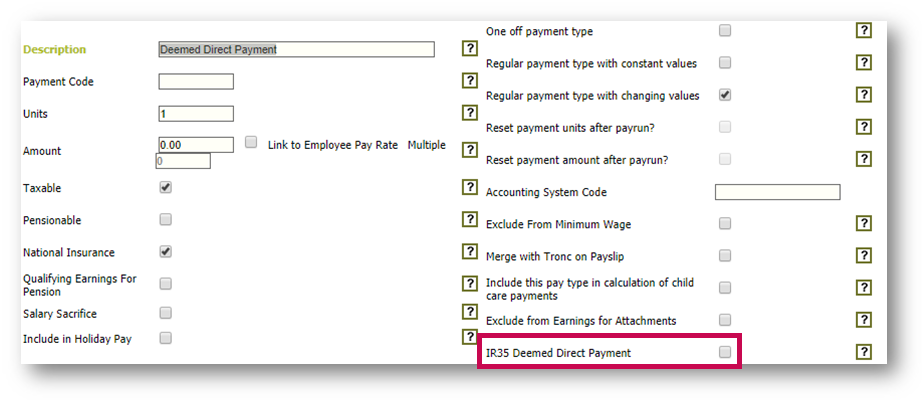

There has been a flag added to the Payment Type Creation screen so that payments made to contractors that fall within OR35 regulations can be identified and reported on.

- Go to Payroll Module > Administration > Payment Types > Add New Payment Type

- Tick the IR35 Deemed Direct Payment box

- Select Save

Fig.5 – Payment Type Screen

Employee Creation

A new flag has been added to the Employee Personal Details page which allows an employee to be flagged as a contractor who falls within IR35 regulations.

- Go to HR Module > Employees > Create New Employee

- Tick the IR35? box

- Select Save

Fig.6 - Personal Details Page

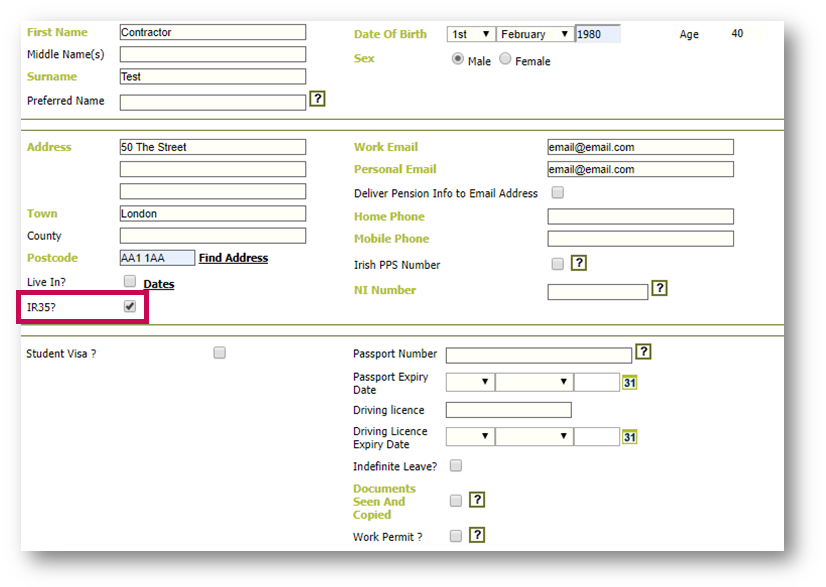

Once flagged, the page has added validation which makes a number of fields that would usually be mandatory, non-mandatory, so the creation process can be completed without the requirement of adding data which would not usually be collected for contractors.

Fig.7 - IR35 Personal Details Page

When the IR35? flag is ticked, the following fields, which would normally be mandatory, become hidden:

- Source

- Nationality

- Country of Residence

- Proof of Eligibility

- Proof of Eligibility Comments

When going to the Employment Details page, the following details will would normally be mandatory for employees, will be hidden:

- Salary or Hourly rate information

- Contract

- Contracted Hours

Fig.8 - IR35 Employment Details Page

Rehire Employee

If an employee is flagged as IR35 in their Personal Details page, they will not be able to be rehired.

- Go to HR Module > Employees > Rehire Employee

- Select the Employee

When an IR35 employee is selected for rehire, the message as shown in Fig.9 will appear.

Fig.9 - Rehire Employee Information Box

Comments

Please sign in to leave a comment.