Overview

The following document outlines the process to transfer an employee from one pension scheme to another.

This process will need to be followed if an employee is already in another pension scheme and an alternative is required, for example, if an employee moves from one pay basis/frequency to another. Each pay basis has a separate default pension scheme with the appropriate pension thresholds and must match the pay basis the employee is attached to.

For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

Employee Pension Scheme Transfer

To transfer the pension scheme, select the employee’s record in the payroll or pension module. To do this, navigate to: Pension Module > Employees > Employee List > Select Employee > Employee Pension Info > Pensions.

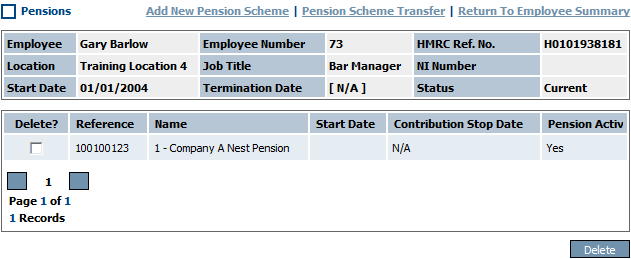

Fig 1 – Pensions Page

- This page shows the current active pension screen.

- In order to change the pension scheme, click the ‘Pension Scheme Transfer’ link.

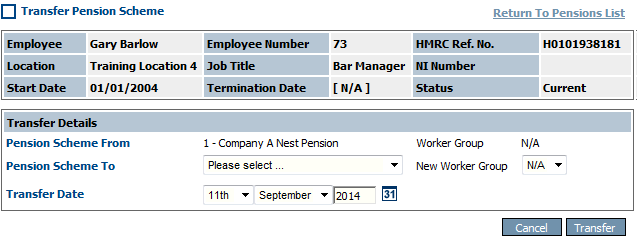

Fig 2 – Transfer Pension Scheme Page

- The system will display the current pension scheme and worker group if applicable.

- Select the new pension scheme from the drop down list of available schemes for the employee’s current pay basis.

- Select a new worker group from the drop down list if applicable.

- Select a transfer date. This date must be the start of the current pay reference period.

- Once completed, click the ‘Transfer’ button.

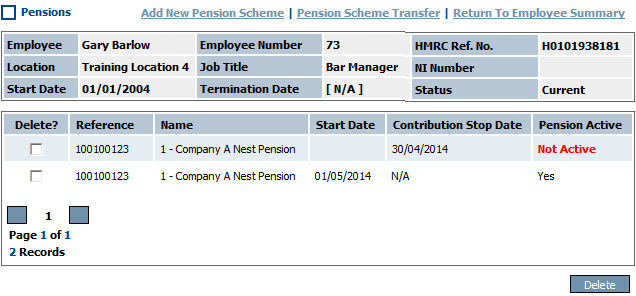

The system will start a new pension record from the transfer date and stop the previous record the date before.

Fig 3 – Updated Pensions Page

- The original pension scheme will change to show ‘Not Active’, showing the original scheme has been stopped.

Note: Please be aware of pay reference periods when transferring employees from one pension scheme to another. If a change of pay basis has taken place, ensure there are no dates between the pension reference periods that require a deduction.

E.g. Last pension reference period: 01/05/2014 – 31/05/2014; new pension reference period: 06/06/2014 – 05/07/2014. In this example, the deduction must be adjusted to ensure pension is deducted over the dates between pension reference periods (01/06/2014 – 05/06/2014). A pro rata calculation to cover 5 days will need to be added to the payroll using the override function on the payroll summary.

Comments

Please sign in to leave a comment.