Overview

The following document outlines the process of transferring a pension scheme record. For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

Changing the Pension Eligibility

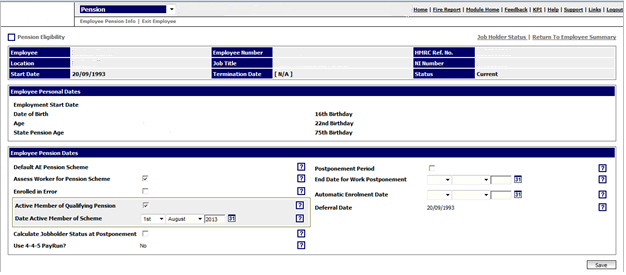

- To begin, navigate to the employee’s pension eligibility record by following: Pension Module > Employees > Employee List > Select Employee > Employee Payroll Info > Pension Eligibility.

Fig 1 – Pension Eligibility Screen

- Ensure the ‘Active Member of Qualifying Pension’ has a tick assigned to the field.

- In the ‘Date Active Member of Scheme’ field, enter the staging date for the PAYE company in use.

Note: This will always be the same date, as the Pension Module must recognise the scheme was in place before auto enrolment began in order to exclude the employee from the automatic enrolment process in the new PAYE process.

Creating the Pension Record

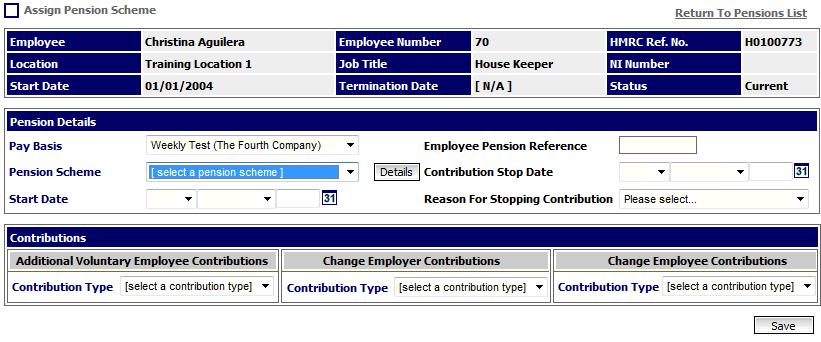

Once the pension eligibility has been updated, a new pension record should be created. To do this, navigate to the Assign Pension Scheme page by following: Employee Pension Info > Pensions > Add New Pension Scheme.

Fig 2 – Assign Pension Scheme Page

- In the ‘Start Date’ field, use the start date of the pay reference period where the employee has been added to payroll.

- Update the ‘Contribution Type’ percentages in the ‘Change Employer’ and ‘Change Employee’ contribution fields.

- When ready, select save. Access the payroll summary to check the pension scheme contribution values are showing as expected.

Comments

Please sign in to leave a comment.