What’s Changing?

A new global setting is being introduced that will allow customers to choose to include any additional payments that are in the current pay run within the additional holiday pay calculation.

Release date: 28th March 2019

Reason for the Change

To allow customers the flexibility of which 12 week period the additional holiday pay is calculated against.

Customers Affected

All HR & Payroll customers.

Release Notes

Global Setting

A new Global Setting will be created to include any additional payments that are in the current pay run within the additional holiday pay calculation.

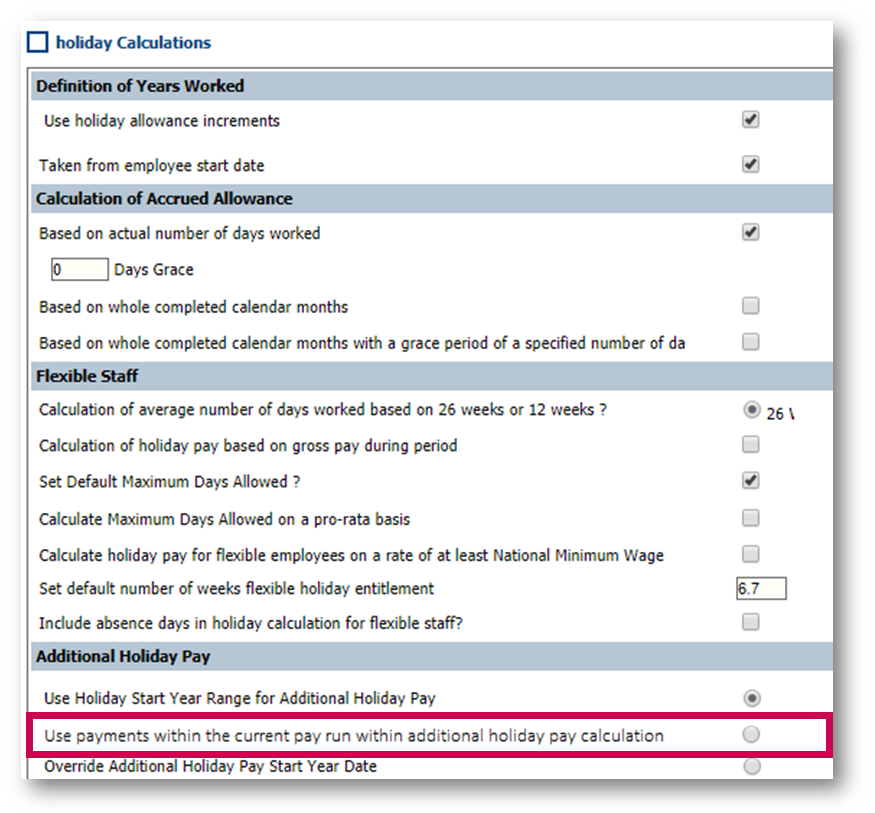

Fig.1 – New Additional Holiday Pay setting

The setting will be turned off by default when the release is made. The system will continue to function as it currently does.

By turning the setting on, any additional payments that are in the current pay run within the additional holiday pay calculation are included.

How & When is the Additional Holiday Pay Calculated Today?

The Additional Holiday Pay is calculated only on the first 20 days of the statutory leave entitlement (within the holiday year) and is paid as the name suggests; in addition to the basic holiday pay an employee already receives for each holiday taken. It is calculated for all authorised holidays.

The Additional Holiday Pay for holidays booked in advance is calculated within the Pay Period in which the holiday days are taken.

The calculation method is broken into three parts:

1. Identifying Relevant Period

This is usually the 12 week period in which an employee was paid before the Start Date of the Pay Period in which they are absent on holiday.

The end of the relevant period is the last day before the start of the pay period in which the employee is absent on holiday.

The start of the relevant period is the first day of week 1 of the 12 week period preceding the end date.

For example:

An employee is paid monthly (calendar month pay periods)

Exceptions:

Retrospective Holidays - Where a holiday day is entered into the system and authorised retrospectively the relevant period used for the calculation is the 12 week period immediately preceding the pay period in which the holiday day fell.

For example:

An employee is paid monthly (calendar month pay periods)

Holidays Paid in Advance - Where a holiday day is entered into the system, authorised and paid in advance manually by agreement, there will be no automated calculation for Advanced Holiday Pay

Where 12 weeks of data for the relevant period isn’t available in the system, the time period for the relevant period will be identified as per the previous examples using only data that is available

For example:

An employee is paid monthly (calendar month pay periods)

2. Calculation of Average Weekly on Additional Holiday Pay elements (AWAHP) within the Relevant Period

AWAHP is the weekly average of the sum of all earnings for payment types flagged as include in holiday pay and paid within the relevant period. The actual calculation varies depending on the pay frequency, as follows:

For a weekly payroll it is:

For a monthly payroll it is:

For fortnightly or 4 weekly payroll it is:

Note: Where an employee has not received any payment for all payment types flagged as include in holiday pay within the relevant period, the average value will be zero. In this case there will be no Additional Holiday Pay owed to the employee.

3. Calculation of Additional Holiday Pay

The following table describes the calculation of Additional Holiday Pay for Full Time, Part Time and Flexible employment types.

What Fourth will do

To include any additional payments that are in the current pay run within the additional holiday pay calculation, Fourth will change the relevant period range but no changes will be done to the calculation.

The end of the relevant period will be the last day of the pay period in which the employee is absent on holiday.

Meanwhile, the start of the relevant period will remain the first day of week 1 of the 12 week period preceding the end date.

For example:

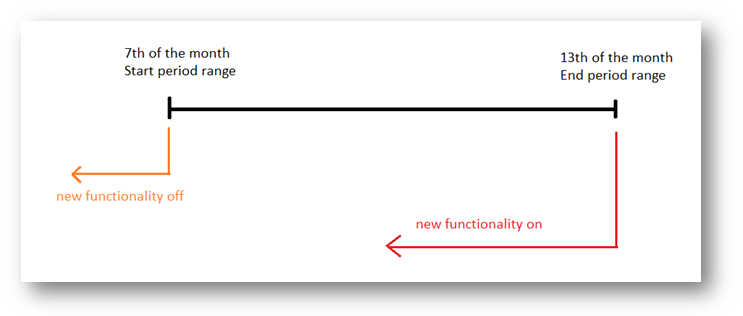

Fig.2 – Period range changes

In this example, there is a relevant period starting from the 7th until the 13th. Today, without the new Additional holiday pay functionality, the calculation will go back from the 7th. If the new functionality - Use payments within the current pay run within additional holiday pay calculation – is turned on, the calculation will go back from the 13th.

A new global setting is being introduced that will allow customers to choose to include any additional payments that are in the current pay run within the additional holiday pay calculation.

Release date: 28th March 2019

Reason for the Change

To allow customers the flexibility of which 12 week period the additional holiday pay is calculated against.

Customers Affected

All HR & Payroll customers.

Release Notes

Global Setting

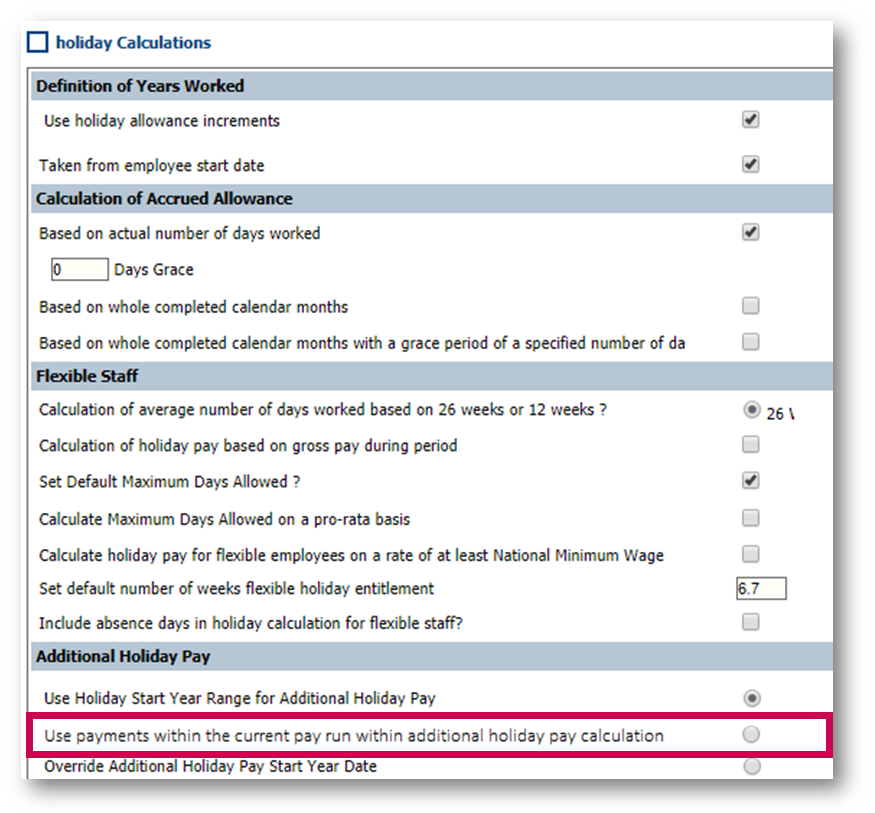

A new Global Setting will be created to include any additional payments that are in the current pay run within the additional holiday pay calculation.

- Go to HR > Administration > Global Settings > Edit Default Holiday Settings

- Select Holiday Calculations

- Under the Additional Holiday Pay section, the new setting will be called: Use payments within the current pay run within additional holiday pay calculation

Fig.1 – New Additional Holiday Pay setting

The setting will be turned off by default when the release is made. The system will continue to function as it currently does.

By turning the setting on, any additional payments that are in the current pay run within the additional holiday pay calculation are included.

How & When is the Additional Holiday Pay Calculated Today?

The Additional Holiday Pay is calculated only on the first 20 days of the statutory leave entitlement (within the holiday year) and is paid as the name suggests; in addition to the basic holiday pay an employee already receives for each holiday taken. It is calculated for all authorised holidays.

The Additional Holiday Pay for holidays booked in advance is calculated within the Pay Period in which the holiday days are taken.

The calculation method is broken into three parts:

- Identifying Relevant Period

- Calculation of Average Weekly on Additional Holiday Pay elements (AWAHP) within the Relevant Period

- Calculation of Additional Holiday Pay

1. Identifying Relevant Period

This is usually the 12 week period in which an employee was paid before the Start Date of the Pay Period in which they are absent on holiday.

The end of the relevant period is the last day before the start of the pay period in which the employee is absent on holiday.

The start of the relevant period is the first day of week 1 of the 12 week period preceding the end date.

For example:

An employee is paid monthly (calendar month pay periods)

- They take 1 day’s holiday on July 15th

- The holiday falls in the pay period from 1-31st July

- The relevant period to calculate average earnings for Additional Holiday Pay is: 7th April – 30th June (note: actual dates may vary slightly in different years)

Exceptions:

Retrospective Holidays - Where a holiday day is entered into the system and authorised retrospectively the relevant period used for the calculation is the 12 week period immediately preceding the pay period in which the holiday day fell.

For example:

An employee is paid monthly (calendar month pay periods)

- They take 1 day’s holiday on June 26th but it wasn’t entered into the system until July 1st, after the June pay period had been calculated and paid

- The holiday fell in the pay period from 1-30th June

- The relevant period to calculate Average earnings for Additional Holiday Pay is: 8th March – 31st May (actual dates may vary slightly in different years)

Holidays Paid in Advance - Where a holiday day is entered into the system, authorised and paid in advance manually by agreement, there will be no automated calculation for Advanced Holiday Pay

Where 12 weeks of data for the relevant period isn’t available in the system, the time period for the relevant period will be identified as per the previous examples using only data that is available

For example:

An employee is paid monthly (calendar month pay periods)

- They take 1 day’s holiday on July 15th

- The holiday falls in the pay period from 1st-31st July

- The relevant period to calculate average earnings for Additional Holiday Pay is: 7th April – 30th June (actual dates may vary slightly in different years)

- The employee was a new starter on 1st June, therefore there is only 4 weeks of pay data.

- The calculation (see point 2 below) uses only the numbers of weeks available, in this case the sum of any earnings are divided by 4 instead of the standard 12

2. Calculation of Average Weekly on Additional Holiday Pay elements (AWAHP) within the Relevant Period

AWAHP is the weekly average of the sum of all earnings for payment types flagged as include in holiday pay and paid within the relevant period. The actual calculation varies depending on the pay frequency, as follows:

For a weekly payroll it is:

- Divided by 12 (the number of weeks in the relevant period)

For a monthly payroll it is:

- Divided by the number of months in the relevant period

- Multiplied by 12 (number of moths in the year)

- Divided by 52 (number of weeks in the year)

For fortnightly or 4 weekly payroll it is:

- Divided by the number of whole weeks in the relevant period

Note: Where an employee has not received any payment for all payment types flagged as include in holiday pay within the relevant period, the average value will be zero. In this case there will be no Additional Holiday Pay owed to the employee.

3. Calculation of Additional Holiday Pay

The following table describes the calculation of Additional Holiday Pay for Full Time, Part Time and Flexible employment types.

| Employment Type | Holiday Taken in Days | Holiday Taken in Hours | Notes |

| Full Time / Part Time | AHP = Holidays Days Booked * (AWAHP / FTE Days) |

AHP = Holidays Days Booked * (AWAHP / FTE Hours) |

Depending on data available FTE Days and FTE Hours are taken in this order of precedence: 1. Employee Level 2. Job Title / Location 3. Job Title If none present, it defaults to: - FTE Days = 5 - FTE Hours = Contracted Hours if present, otherwise: FTE Hours = 40 |

| Flexible | AHP = Holiday Days Booked * (AWAHP / Average Days) | N/A (holidays can be booked in Days, only) | Average Days (existing system functionality) are calculated and stored on a daily basis by the overnight service. Historical Average is stored per weekly basis. |

What Fourth will do

To include any additional payments that are in the current pay run within the additional holiday pay calculation, Fourth will change the relevant period range but no changes will be done to the calculation.

The end of the relevant period will be the last day of the pay period in which the employee is absent on holiday.

Meanwhile, the start of the relevant period will remain the first day of week 1 of the 12 week period preceding the end date.

For example:

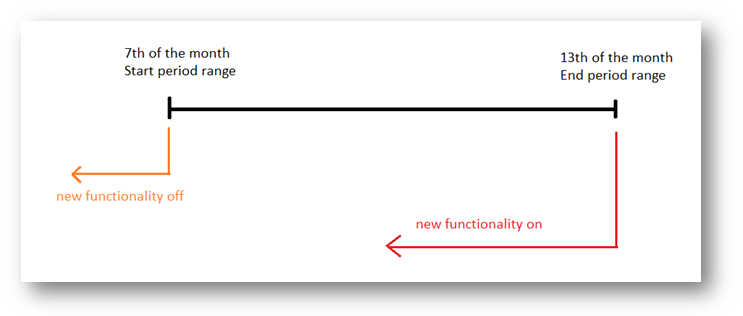

Fig.2 – Period range changes

In this example, there is a relevant period starting from the 7th until the 13th. Today, without the new Additional holiday pay functionality, the calculation will go back from the 7th. If the new functionality - Use payments within the current pay run within additional holiday pay calculation – is turned on, the calculation will go back from the 13th.

Comments

Please sign in to leave a comment.