What’s Changing?

New functionality to allow suppliers to send header-level charges in electronic invoices and credit notes in the segment called "SAC". SAC segments values will be imported and distributed across in Inventory.

Release date: 25th January 2022

Reason for the Change

Inventory supports single header-level charges but they are not supported on the import of electronic invoices and credit notes. With the new functionality, suppliers will be able to send header level charges in electronic invoices and credit notes.

Customers Affected

All Inventory customers receiving electronic invoices and credit notes with rates and fright, from suppliers submitting X12 invoices.

Release Notes/Steps

- Enabled by Default? - Yes

- Set up by customer Admin? - Yes

- Enable via Support ticket? - No

- Affects configuration or data? - No

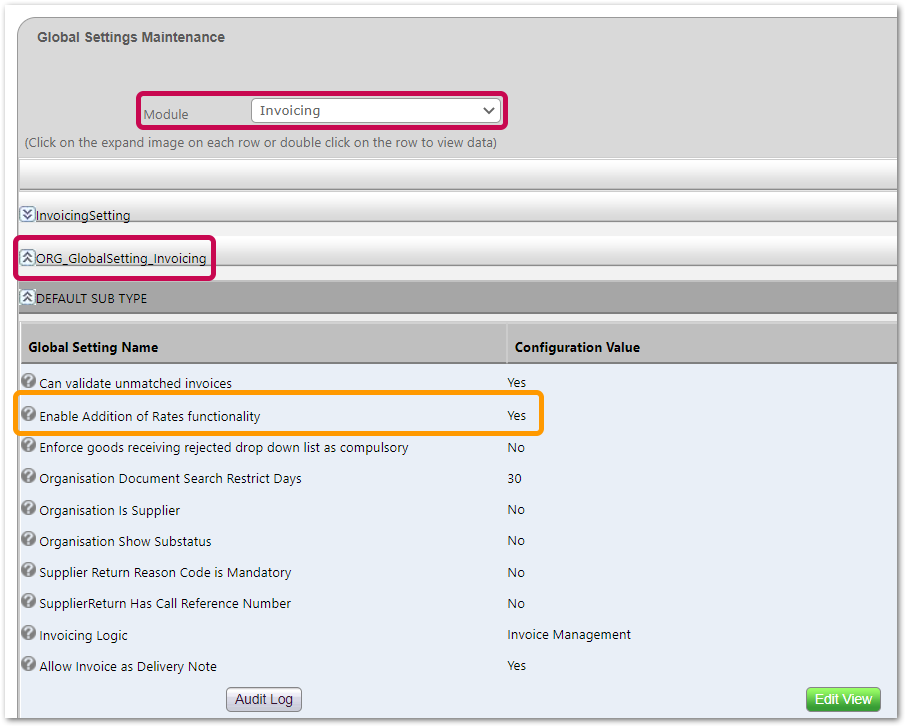

An existing organisation level setting needs to be enabled - Enable Addition of Rates functionality

- To access the setting, go to Setup > All Options > Global Settings (under 'Company Admin')

- Use the Module drop-down menu and select Invoicing

- Expand ORG_GlobalSetting_Invoicing

- Select Edit View, and then Edit

- Apply the setting Enable Addition of Rates functionality Stock and Save changes

Fig.1- ORG_GlobalSetting_Invoicing > Existing Setting

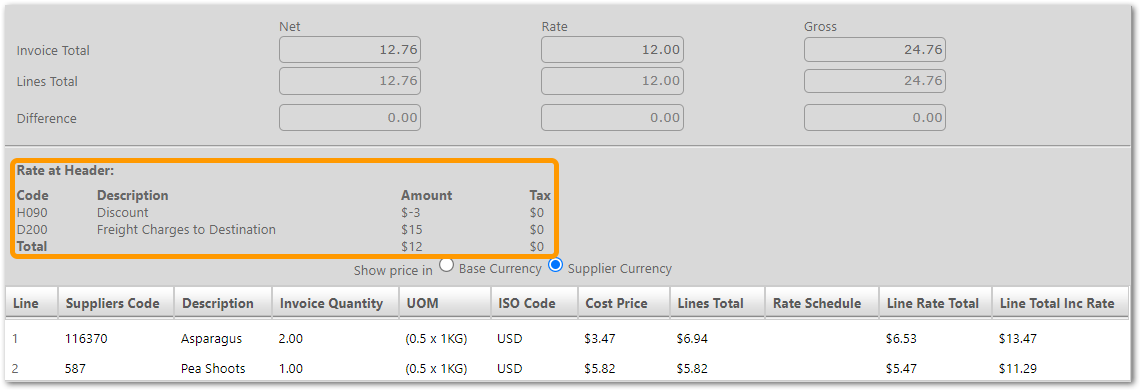

When an electronic invoice is sent with SAC segment charges and is imported successfully to Inventory, for the below example (Fig.2), SAC segment charges are displayed in the “Rate at Header” section in the invoice document.

Example:

|

Code |

Description |

Amount |

Tax |

|

D200 |

Freight Charges to Destination |

15 |

0 |

|

H090 |

Discount |

-3 |

0 |

Fig.2 - SAC segment charges for invoice displayed at Rate at Header

Fig.2 - SAC segment charges for invoice displayed at Rate at Header

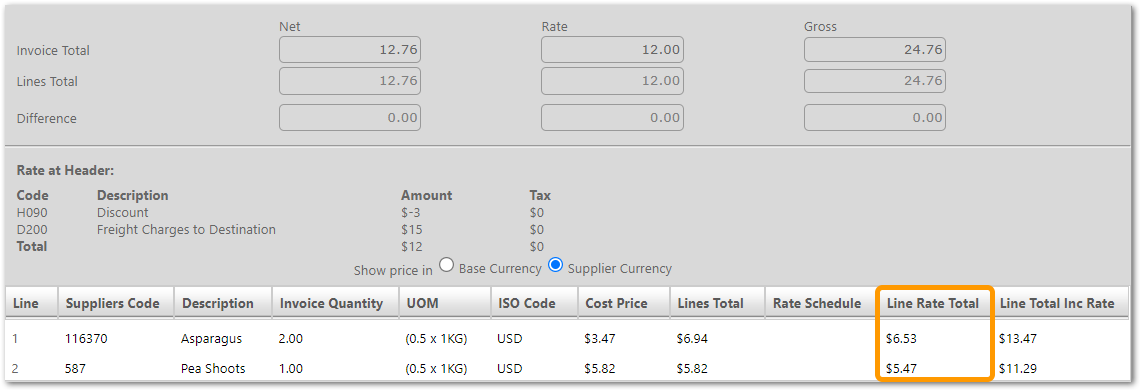

The sum of total allowances and charges is distributed across the invoice, relative to the net line value of each line.

In the above example (Fig.2), the sum of total allowance and charges is $12 and the net line total is $12.76. This is distributed as (Line Total÷Net Line Total) x sum of total allowance and charges.

- Line 1: Line Rate Total = 6.94÷12.76 x 12 = 6.5266 = 6.53 (2 d.p.)

- Line 2: Line Rate Total = 5.82÷12.76 x 12 = 5.4733 = 5.47(2 d.p.) - see Fig.3

Fig.3- Line Rate Total for Invoice

Fig.3- Line Rate Total for Invoice

On processing the invoice, where there is a GRN threaded, the rate is looked up from the GRN header for the sum of SAC segment to be related to. If a rate is not specified at the GRN header then the rate is associated with the system default rate called ‘system rate’.

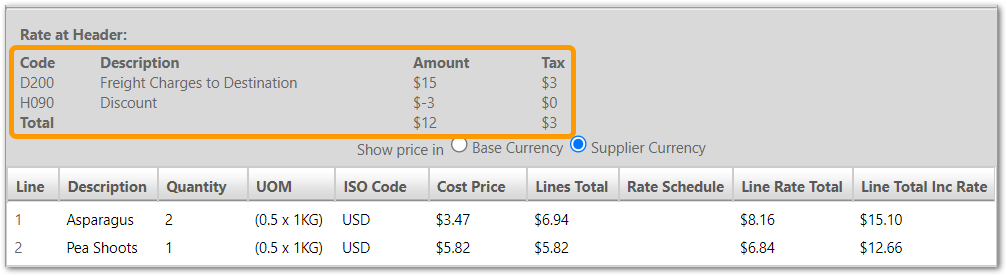

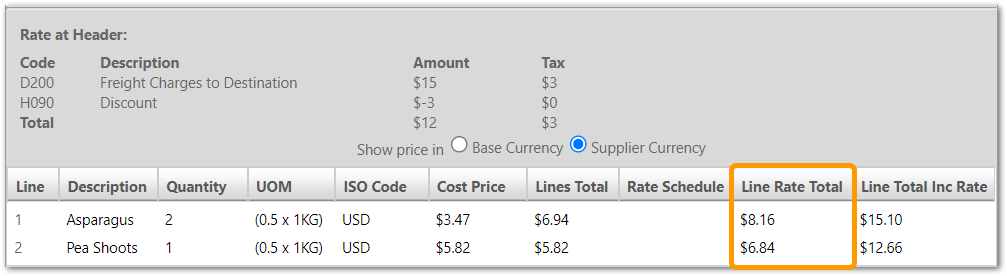

Similarly, when an electronic credit note is sent with SAC segment charges and the file is imported successfully to Inventory, the SAC segment charges are displayed in the “Rate at Header” section on the credit note document (see Fig.4).

Example:

|

Code |

Description |

Amount |

Tax |

|

D200 |

Freight Charges to Destination |

15 |

3 |

|

H090 |

Discount |

-3 |

0 |

Fig.4- SAC segment charges for credit notes displayed at Rate at Header.

Fig.4- SAC segment charges for credit notes displayed at Rate at Header.

The sum of total allowance, charges, and tax are distributed across credit notes relative to the net line value of each line.

In the above example (Fig.4) the sum of charges and allowance is $15 and the net line total is $12.76.

This is distributed as: (Line Total÷Net Line Total) x sum of total allowance and charges

- Line 1: Line Rate Total = 6.94÷12.76 x 15 = 8.1583= 8.16 (2 d.p.)

- Similarly for Line 2: Line Rate Total = 5.82÷12.76 x 15 = 6.8416 = 6.84(2 d.p.) - see Fig.5

Fig.5- Line Rate Total for Credit Note

Fig.5- Line Rate Total for Credit Note

On processing the credit, where there is an invoice threaded to it, the rate is looked up from the invoice header for the sum of SAC segment to be related to. If a rate is not specified at the invoice header, then the rate is associated with the system default rate called ‘system rate’.

Comments

Please sign in to leave a comment.