Overview

In response to the ongoing uncertainty around the sudden increase in COVID-19 cases, the UK Government has introduced some temporary changes to guidance and business support.

More information will be published here if further announcements are made over the next few weeks.

Temporary Changes to Fit Note Guidance

Doctors issue 'fit notes' to people to provide evidence of the advice they have given about their fitness for work. They record details of the functional effects of their patient’s condition so the patient and their employer can consider ways to help them return to work (definition taken from https://www.gov.uk/government/collections/fit-note).

Previously, employers were required to request a fit note from employees who had been off work with sickness for longer than 7 consecutive days. Employees were able to self-certify sickness for the first 7 days.

On 16th December 2021, the UK Government announced that they were temporarily changing the fit note guidance and that doctors had been advised not to issue fit notes for the first 28 days of sickness, which will allow them to concentrate on the COVID-19 booster vaccine drive.

![]() Employers should continue to pay the allowed Statutory Sick Pay (SSP) to employees who self-certify for 28 days, and should not request a fit note earlier than 28 days from the start of the sickness.

Employers should continue to pay the allowed Statutory Sick Pay (SSP) to employees who self-certify for 28 days, and should not request a fit note earlier than 28 days from the start of the sickness.

This guidance applies to sickness starting on or after 10th December 2021 and is expected to be removed on 27th January 2022.

Absences within HR & Payroll

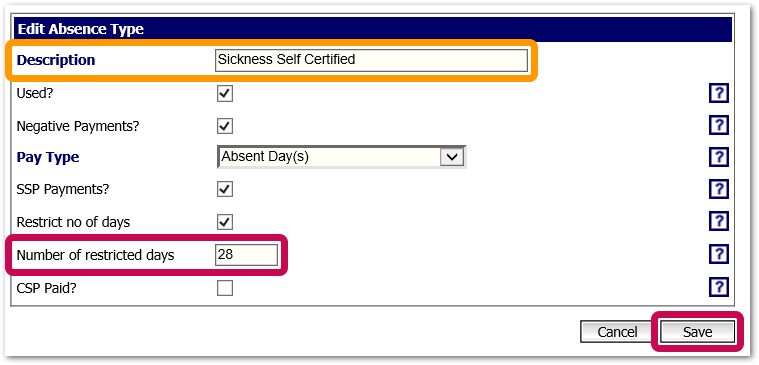

Most customer portals have an Absence Type for self-certified sickness, restricted to a maximum of 7 days SSP. This restriction can be updated within the Absence Type.

- To update the absence type, go to either the Payroll or HR module and select Administration > Absence Types > Sickness Self Certified

- For the Number of restricted days enter 28

- Select Save

Fig 1. Editing an Absence Type

Make a note to revert this setting back to 7 following the end of the temporary guidance change on 27th January 2022

Make a note to revert this setting back to 7 following the end of the temporary guidance change on 27th January 2022

Return of the SSP Rebate Scheme for Small Employers

On 21st December 2021 it was announced that the previous SSP rebate scheme would return for small employers, who will be able to claim money to cover SSP paid to employees affected by COVID-19.

The scheme will start again from 21st December 2021 and claims can be made retrospectively from mid-January. It is open to UK-based employers with a PAYE payroll and less than 250 employees as of 30th November 2021.

To claim, the employee(s) must already have been paid the SSP.

Employers can claim for 2 weeks SSP per employee who has had time off due to coronavirus. The previous 2-week limit has been reset, so employers will be able to claim up to two weeks per employee, regardless of whether they have claimed for them previously.

Further information can be found in this factsheet that has been published by HRMC.

New Terms/Acronyms

- Fit note - An official written statement of fitness to work by a doctor

- SSP - Statutory Sick Pay

Comments

Please sign in to leave a comment.