The Change

We have developed functionality which allows administrators to use a new global setting, ‘Documents Number of Decimals’, to define the number of decimal places allowed for a cost price of an invoice item.Release Date: 25-Nov-2015

Reason for the Change

There are instances when reconciling invoices that the Net value is matching but the VAT and Gross values are out by a penny. This happens if the supplier has cost prices that utilise more than 2 decimal places.Customers Affected

This is available to all Inventory customers with the Stock Module and Invoicing enabled.Release Notes

Global Setting

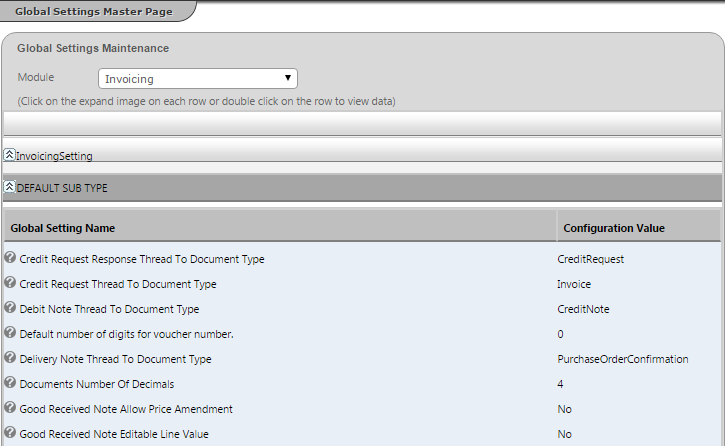

Fig 1 – Global Setting

- Follow the path: Setup tab > All Options > Global Settings > Select ‘Invoicing’ from the Module Drop-down list.

- Click the green ‘Edit View’ button

- Scroll across and find the setting ‘Documents Number of Decimals’.

- Enter the desired number of decimal places and click the green ‘Save’ button for the changes to take effect.

Note: Changes to Global Settings may need to be carried out by Fourth personnel.

Updates to Invoice Validation Page

After approving a GRN and clicking the ‘Record Invoice’ button to create a new invoice, complete the header details.

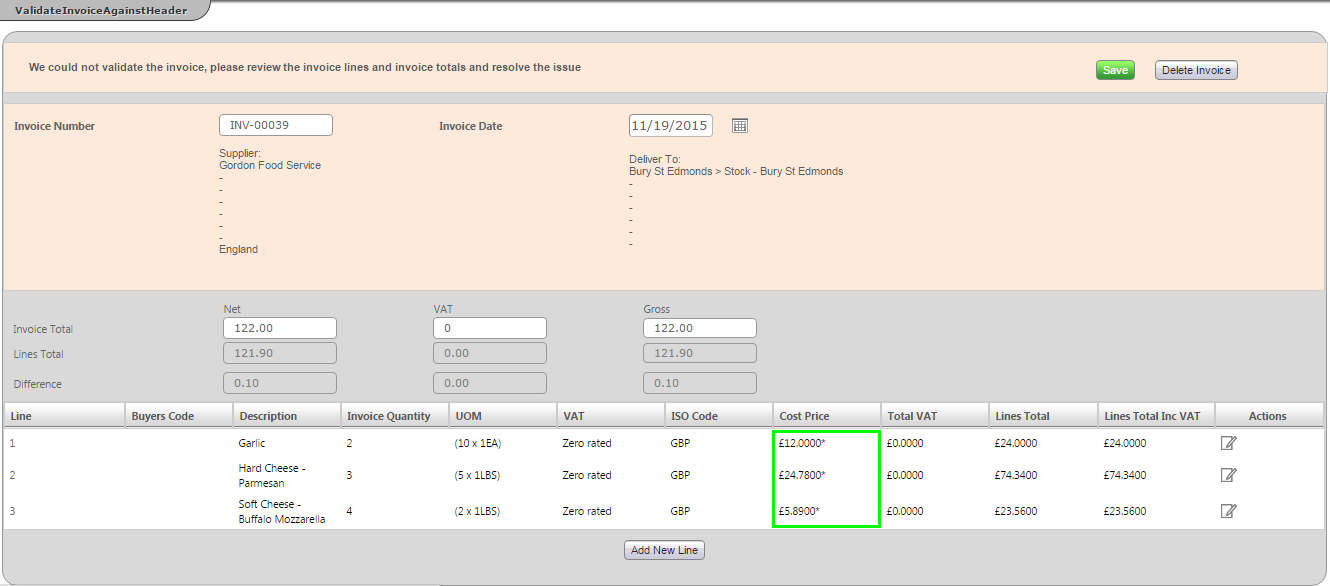

Fig 2 – Updated Invoice Validation Screen

- The number of decimal places configured in the Global Setting section above will appear as in Fig 2.

- This will allow users to enter cost prices with the decimal places up what was configured above.

- The line totals are all that will have the decimal rounding.

- The header totals will always round to 2 decimal places since that’s what suppliers are paid in.

- NOTE: the Gross total in the header is the sum of the rounded Net and VAT totals not the sum of the Gross line level total.

- The same decimal rounding can be seen for invoices that are sent electronically if that is how the supplier wishes to send them.

Comments

Please sign in to leave a comment.