Parental Leave Calculations after Furlough

If an employee was on furlough and was paid with the help of the Coronavirus Job Retention Scheme (CJRS) during any part of the relevant 8 week period, there are slightly different rules about how to calculate their average weekly earnings (AWE) if they are due to start a period of family-related statutory pay on, or after, 25th April 2020.

This is to ensure that employees:

- Are eligible for Statutory Maternity, Adoption, Paternity, Shared Parental or Bereavement pay

- And that their Average Weekly Earnings (AWE) are not affected if lower than normal as a result of being furloughed

The new rules will apply when an employee’s period of parental pay begins on or after 25th April 2020.

If the employee was on furlough for part, or all of, the relevant 8 week period, the earnings used to calculate AWE should be the higher of either:

- What they receive from their employer

Or

- What they would have received from their employer had they not been on furlough

Where it is not clear what the employee would have received had they not been on furlough, a likely start point would be the reference salary used to calculate how much to claim through CJRS. However, a consideration should be made for other payments, such as commission or bonus, as they were not included in the reference salary calculation.

HR & Payroll Calculation

The calculation within Workforce Management looks at the data that has been paid to employees via the payslip. Any NIable pay within the relevant 8 week period is used to calculate the AWE.

Because of this, the system will automatically use the furlough amount when calculating eligibility and the first 6 weeks of pay for maternity leave. This means that for a short period of time, system calculations will need to be reviewed and overwritten, if necessary.

Identifying the Relevant Period of Earnings

The Relevant Period of Earnings can be found within the employee’s statutory leave page once a leave period has been created.

- To find the relevant period of earnings for Maternity leave, go to Payroll > Employees > Employee List

- Search for and select the employee

- Go to Employee Payroll Info > Statutory Maternity Pay

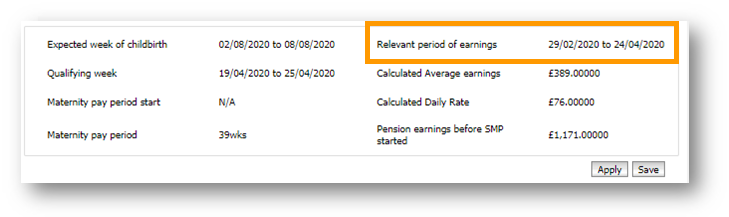

Fig.1 - Relevant period of earnings on the Statutory Maternity page

Fig.1 - Relevant period of earnings on the Statutory Maternity page

To work out the relevant period of earnings manually, the qualifying week needs to be known.

The qualifying week is the 15th week (Sunday to Saturday) before the week that the baby is due.

For a baby due on 4th August 2020, the qualifying week will be 19th – 25th April 2020

The relevant period of earnings are the 8 weeks prior to the qualifying weeks (the end is the last normal payday on, or before the Saturday of the qualifying week).

For a qualifying week commencing 19th April, the relevant period will be 29th February – 14th April 2020

Calculating the Average Weekly Earnings

Now that the relevant period of earnings is known, the average weekly earnings can be calculated.

- For each pay date that falls within the relevant period of earnings, add up the total NIable pay

- For the periods that the employee received a furlough payment, use either the amount they would have been paid if they were working, or an additional 20% on top of the furlough payment made

- Next, work out the average weekly earnings by completing one of the following formulas:

For Monthly – Total NIable pay ÷ 2 (months in period) x 12 (months in year) ÷ 52 (weeks in year) = AWE

or

For Four-weekly, Fortnightly or Weekly – Total NIable pay ÷ 8 = AWE

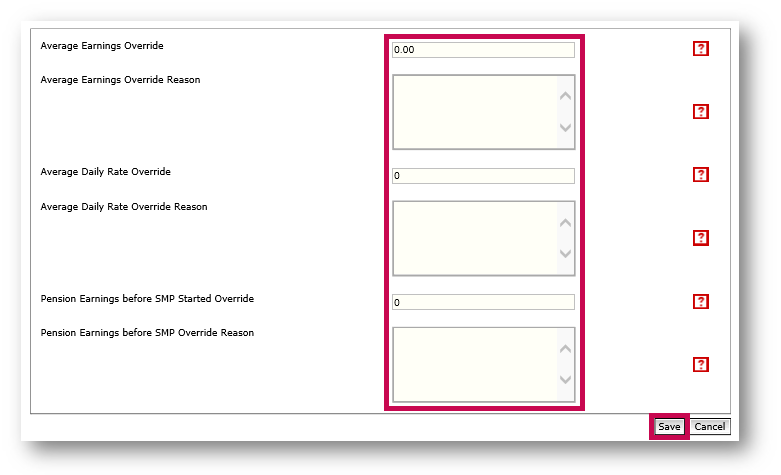

Overriding the Average Earnings for Maternity Pay

If the average weekly earnings differ from the amount that has been calculated by the system, the details will need to be overwritten to ensure the employee is correctly assessed and paid.

- To override average earnings, go to the employee's SMP Record (as per steps when finding relevant period of earnings) and select Override Earnings

- Enter the new weekly Average Earnings Override that have been calculated, and an Override Reason

- Enter the Average Daily Rate Override (weekly rate ÷ 7) and an Override Reason

- Enter the full period average amount in the Pension Earning before SMP Started Override field and an Override Reason

- Select Save

Fig.2 - Overriding Average Earnings

Fig.2 - Overriding Average Earnings

To calculate the period amount:

For Monthly - AWE x 52 ÷ 12

For Weekly- AWE x 1

For Fortnightly – AWE x 2

For Four-Weekly – AWE x 4

Please note: The Override Reason fields are all mandatory - the page cannot be saved unless they are populated.

Once the override information has been saved, the maternity qualification criteria will re-calculate and the screens will be updated.

Comments

Please sign in to leave a comment.