Paying Flexible Furlough – Best Practice

Over the next few weeks, there will be several new articles published in relation to flexible furlough and the changes being made to Workforce Management.

This article pulls together the best practice processes for paying employees under the new flexible furlough rules to ensure that the enhancements can be utilised as much as possible.

Salaried Employees

Salaried employees, although simple in terms of working out usual hours, can be quite complicated in terms of payments.

The Employer Claim export, from July, will only be looking for furlough payments to base the calculations on. This means that the best way to pay employees is via two separate payments - one for the worked portion of pay, and another for the furlough portion.

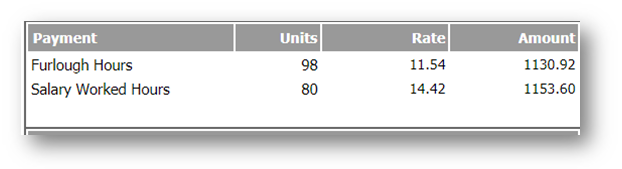

Fig.1 - Example salaried employee hours and amounts

The calculation for furlough has changed to use only the furlough payment, so it’s vital it shows separately for the claim export to calculate the correct ER NIC and pension for July. For August, September and October, the furlough pay amount will simply be reported to HMRC.

Hourly Employees

Typically, hours worked will be entered on the rotas for hourly employees. These hours will feed through to payroll upon closure of the rota and will display as usual on the employees' payslips.

The furlough payment should be calculated and added separately to the rota payments so that they show separately.

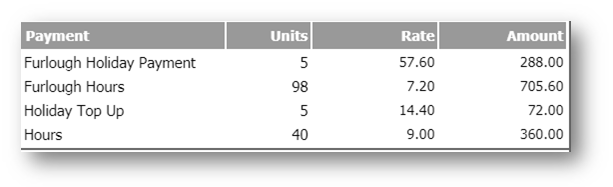

Fig.2 - Example hourly employee hours and amounts

The calculation for furlough has changed to use only the furlough payment, so it’s vital it shows separately for the claim export to calculate the correct ER NIC and pension for July. For August, September and October, the furlough pay amount will simply be reported to HMRC.

Holiday Pay

Holiday pay for furloughed employees should be paid at 100%. Employers can claim back 80% of the holiday pay using the Coronavirus Job Retention Scheme (CJRS).

The best way to make holiday payments to employees who are on furlough is to make two separate payments - one for the claim amount (called furlough holiday, for example) and another for the holiday top-up.

Fig.3 - Example holiday pay hours and amounts

Comments

Please sign in to leave a comment.