Overview

The purpose of this article is to help users configure the system specifically to assess workers for three year re-enrolment purposes.

For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

What is Three Year Re-Enrolment?

Automatic Enrolment legislation states that an employer must re-assess all Eligible Job Holders who no longer contribute to a qualifying pension scheme, and re-enrol them into the scheme. In other words, all eligible job holders who have previously ‘opted – out’ or ‘ceased membership’ must be re-enrolled.

Choosing a Re-enrolment Date

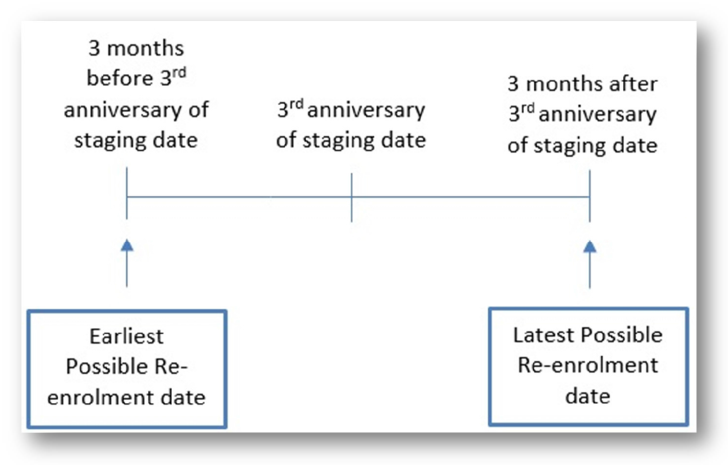

Each employer has a six month re-enrolment window starting from three months before the third anniversary of their original staging date and ending three months after that anniversary.

Fig.1 - 6 month re-enrolment window

For example, if an employer has a staging date of 1st October 2013, their re-enrolment window will be: 1st July 2016 – 1st January 2016

Setting a Re-Enrolment Date in the Pensions Module

Please note – It is important not to enter the re-enrolment date into the portal until being in the correct pay reference period.

Once the re-enrolment date has been decided, this date will need to be set within the Pension Module.

- Log in to the Pension Module

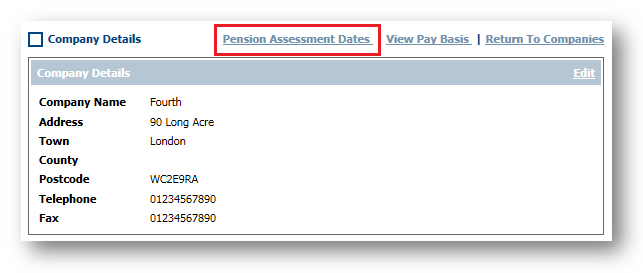

- Go to Administration > Company Setup > Name of Company > Pension Assessment Dates

Fig.2 - Pension Assessment Dates button

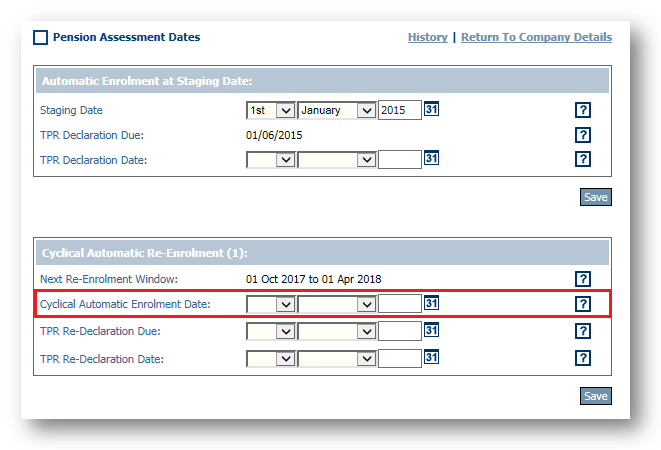

The Pension Assessment Dates screen shows the original staging date and the six month re-enrolment window.

- Enter the Re-Enrolment date on the Cyclical Automatic Enrolment Date field

- Save

Fig.3 - Pension Assessment Date

The Re-enrolment date has now been entered into the company’s record.

Please note: The re-enrolment date should not be entered into the system prior to the correct pay reference period.

Postponement Periods

The three year Re-enrolment legislation states that postponement periods should not be used for the re-assessment and re-enrolment of previously eligible employees.

The system has been developed so that re-enrolled employees will not postpone. Re-enrolled employees will have contributions taken in their next available pay day.

Identifying Workers for Re-assessment

Legislation states that any worker who has opted out, or ceased membership, within a twelve month period prior to a re-enrolment date does not have to be re-assessed.

The employer has the choice of whether to include them or not.

Setting Up the System to Identify Workers

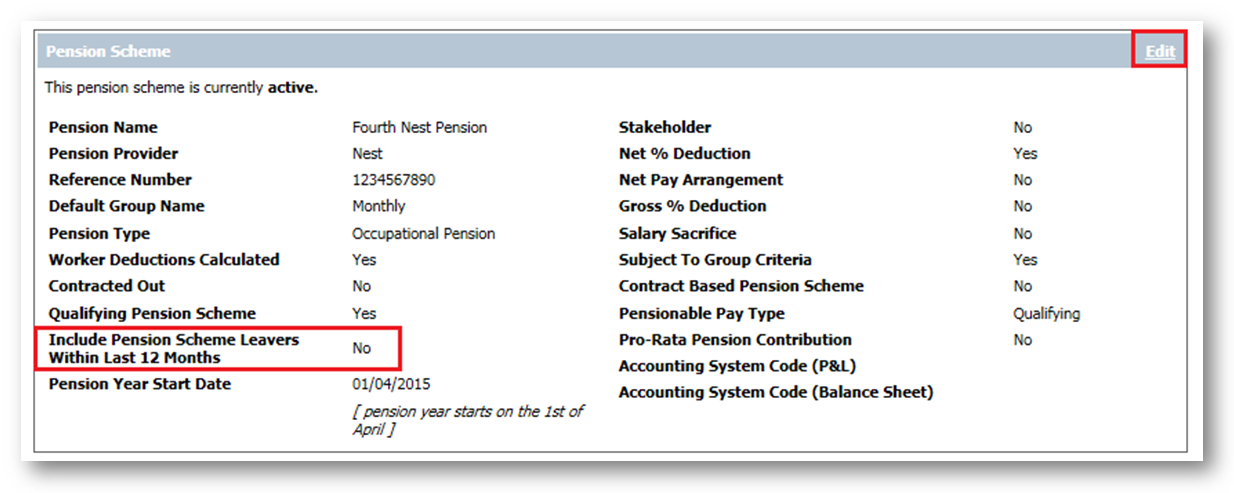

In order for the system to know whether or not to include workers who have opted-out or ceased membership within a twelve month period prior to the re-enrolment date, the correct settings must be flagged within the pension scheme.

- Go to Pension Module > Administration > Pension Scheme > Select Pension Scheme

The scheme setup is set to No by default.

To change this to Yes, select Edit – in the top right hand corner of the screen.

- Put a tick in the box for Include Pension Scheme Leavers Within Last 12 Months

- Save the changes - the button is at the very bottom of the page

Choosing Who to Reassess

There is also another category of workers that can be selected not to be re-assessed under re-enrolment Legislation. Those people are:

- Workers who have primary, enhanced or fixed protection of their pension. It is an employee's responsibility to let their employer know if they fall within this category

- Workers who hold the office of Director within the company. The Director must formally be appointed under the Companies Act 2006

Updating ‘Protected’ Workers or Directors

To update an employee's record so they are no longer included in the re-assessment process, their personal record within the pension module will need to be updated.

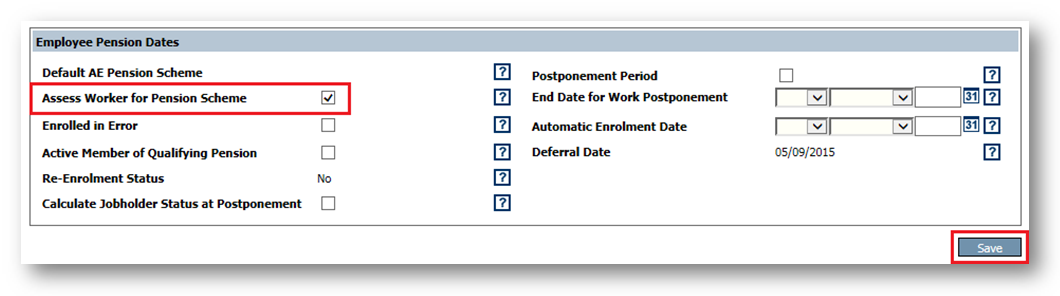

- Go to Pension Module > Employees > Employee List > Search for and select employee

- Once in the employee record, go to Employee Pension Info > Pension Eligibility

- Remove the tick from the Assess Worker for Pension Scheme box and then Save

Fig.5 - Assess Worker for Pension Scheme setting

Amending Letters

Fourth has made it simple to create letters for employees who have re-enrolled. There is no additional re-enrolment trigger within the functionality.

Instead, re-enrolment notifications will use the existing enrolment trigger:

1 – EJ – Automatically Enrolled (NEST: 1/TPR: 1,)

- On the existing template for Enrolment, add the following mail merge fields:

An example of how to include these fields within the letter is:

Calculating Assessment Dates

In order to run the re-enrolment assessment, the Pay Date that holds the Relevant Pay Reference Period will need to be calculated.

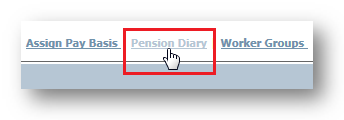

In order to do this, look at the Pension Diary.

- Go to Pension Module > Administration > Pension Scheme > Select Scheme > Pension Diary

Fig.6 - Pension Diary link

This will display the Pension Diary.

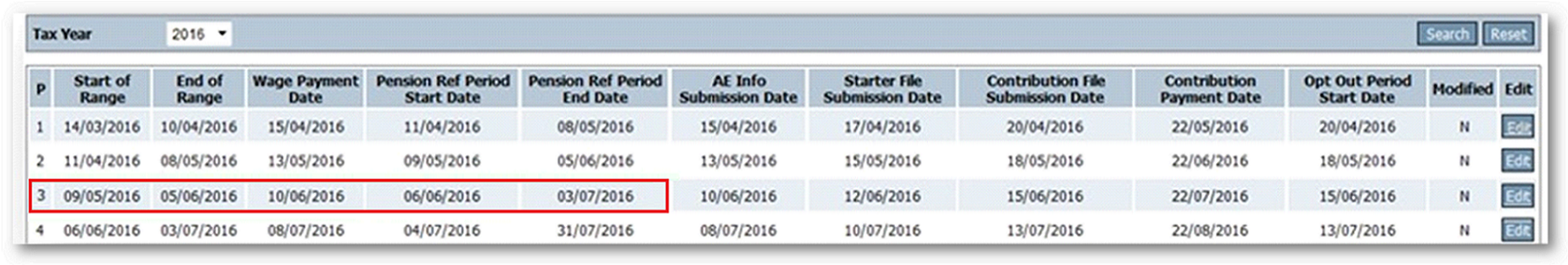

Fig.7 - Pension Diary

The relevant pay reference period is the pay reference period that includes the re-enrolment date. Ensure the re-assessment is run before closing the payroll for the pay date associated with the relevant pay reference period.

Below are two examples. The first is a standard Monthly payroll, the second is a payroll in arrears:

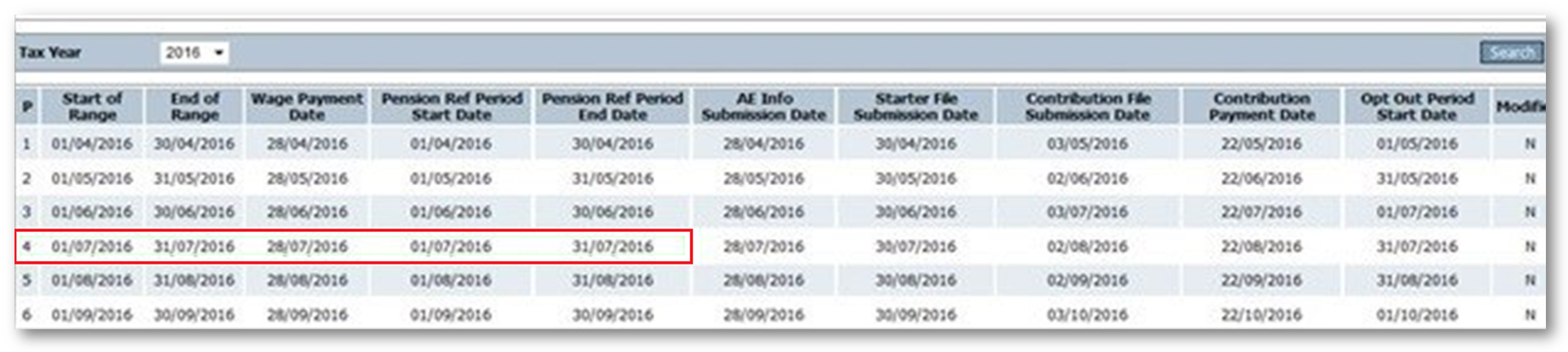

Standard Monthly Payroll

Fig.8 - Standard Monthly payroll

- Re-enrolment Date is 01/07/2016

- Pay reference period that includes re-enrolment date is 01/07/2016 – 31/07/2016

- The Pay Date associated with this pay reference period is 28/07/2016

- The relevant pay reference period is 01/07/2016 – 31/07/2016

- The pay date to work to for running the assessment is 28/07/2016

- The re-assessment will need to be run before the payroll for pay date 28/07/2016 is closed

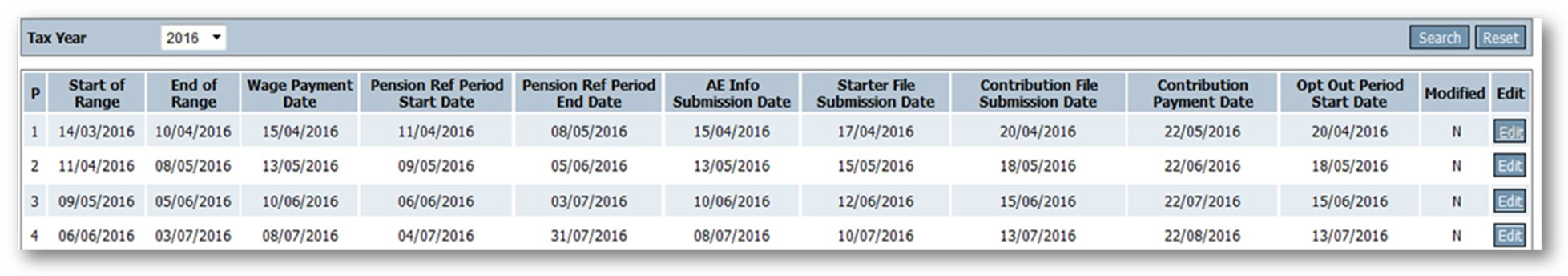

Fig.9 - Payroll in arrears

- Re-enrolment date is 01/07/2016

- Pay Reference Period that includes re-enrolment date is 06/06/2016 – 03/07/2016

- The Pay Date associated with this pay reference period is 10/06/2016

- The relevant pay reference period is 06/06/2016 – 03/07/2016

- The pay date to work to for running the assessment is 10/06/2016

- The re-assessment will need to be run before the payroll for pay date 10/06/2016 is closed

It is essential that the assessment is run in line with what has been calculated and that the re-assessment pay dates are calculated for each pay run.

Running the Re-enrolment Assessment

Now everything has been set up correctly, the three year re-assessment can be run.

Below is checklist of actions in order to successfully re-assess employees.

- Wait until the payroll has been populated with payroll information

- Run a payroll preview (basic) and export to Excel – save down to a local drive

- Set the re-assessment date

- Set whether employees who have left the scheme in the last twelve months will be re-assessed

- Run the re-assessment

Once the above is completed the re-enrolment process can start.

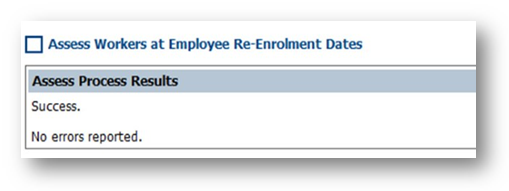

- Go to Pension Module > Pension Process > Assess Workers at Re-Enrolment Dates

- Select the company to be re-assessed

- Select the Pay Basis to be re-assesed

Fig.10 - Successful re-assessment message

Once the re-assessment process is complete:

- Mark any protected workers or directors so as not to re-enrol them

- Run a payroll preview (basic) and export to Excel – save in a local drive

- Compare pension contributions between the pre-assessment preview and post-assessment preview to identify those workers who have been re-enrolled

- Update letters and re-upload to document management

Follow the above process for each pay run, according to the dates that have been calculated in the previous section.

Running the Payroll

The payroll can now be run as normal. Employees will be re-enrolled into the pension scheme on completion of payroll.

Please note: If a pay date is before a re-enrolment date then deductions will not be taken, as contribution deductions are not allowed to taken before the agreed date. Instead, pro-rata'd contributions will be taken in the next payroll.

Next Steps

Once payroll has closed, the following should be completed:

- Send out letters in line with usual timelines

- Declare the re-enrolment to The Pensions Regulator (TPR)

The Pensions Regulator Re-enrolment Declaration

Once the re-assessment has been carried out and the payrolls that re-enrol employees are completed, a declaration of compliance will need to be sent to The Pensions Regulator.

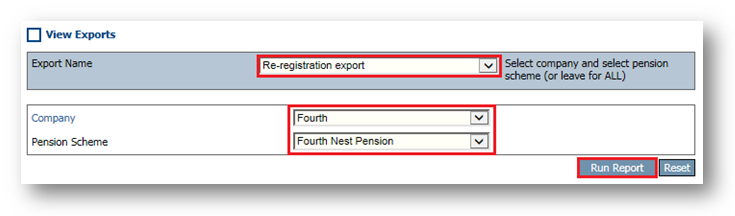

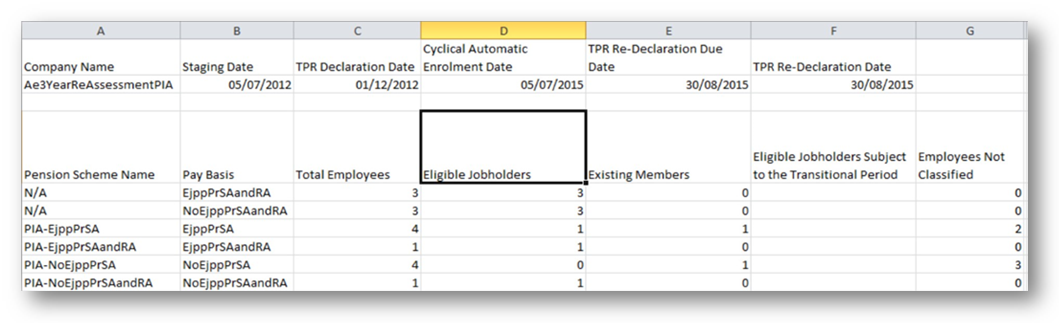

Within the Pension Module there is a report that can be run which will provide the information required for the declaration.

- Go to Pension > Reports > Exports > Re-registration Export

Fig.11 – Export Criteria

- Select the pension scheme to be reported against > Run Report

Fig.12 – Export Criteria

Please note: Re-assessment of employees is an employer’s responsibility. Fourth’s Pension Module has been enhanced to allow users to do this quickly and easily.

Comments

Please sign in to leave a comment.