Overview

If an employee moves from hourly paid to salaried or vice versa, and there is more than one pay run to accommodate this, the Pay Basis will need to be changed. An example of this would be if there is a separate Pay Basis in operation for both the hourly paid and salaried employees.

Please Note: This process is not automated and requires user intervention.

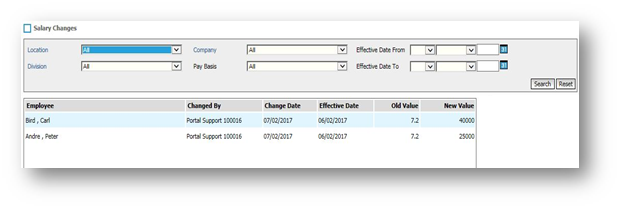

Salary Changes Report

Initially running a report which captures any recent pay changes can support this process.

- To run the Salary Changes report, go to Payroll > Pay Run Admin > View Salary Changes

Recent pay changes for hourly and salaried employees are displayed on the home page.

- To generate specific results within the report, use the Search fields

Fig.1 – Salary Changes Report Criteria

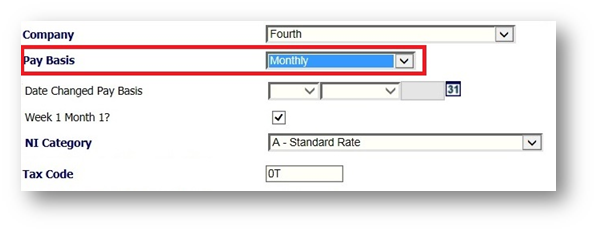

Changing an Employee’s Pay Basis

- Select Employee List from the Employee drop-down menu

- Select the required employee to change the Pay Basis of

- Select Pay and Tax Details from the Employee Payroll Info drop-down

- Within the Pay Basis drop-down, update this to reflect the employee’s correct Pay Basis

Fig.2 – Pay Basis Drop-Down

When an employee moves from hourly to salary, the salary Payment Type must be added to the transferring employee to ensure that this is calculating from the correct date. Please contact a Fourth Payroll Specialist who can assist in this process.

If the employee is moving onto a Pay Basis with a different frequency, e.g. fortnightly to monthly, please be aware that the transferring employee is likely to be taxed twice in one month. The Tax Allowance will only be applicable for the first Payroll in that Period, so the second will be subject to a greater Tax deduction.

The Tax Code may be adjusted in the following Period to reflect this. Please contact a Fourth Payroll Specialist who can assist in this process.

WFM - Payroll Processes Articles

Comments

Please sign in to leave a comment.