Overview

This article contains various troubleshooting tips and FAQs regarding the Fourth Pension Module.

For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

Troubleshooting/FAQs

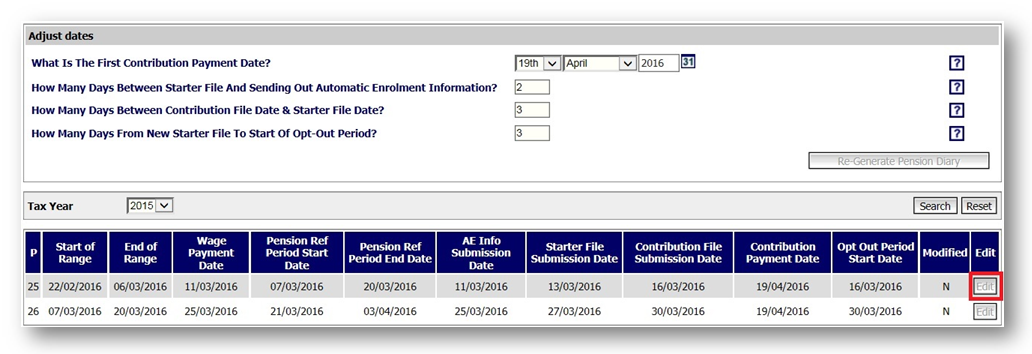

Question/Problem: When I export the latest fortnightly pension report which was paid 11/03/2016 (which covers 22/02/2016 to 06/03/2016), the export comes up with the dates of 07/03/16- 20/03/2016.

This is not in line with the pay period, so we manually change the dates to match the Pension website.

Answer: Pay reference periods and Pension reference periods can be different. It is important to ensure the Pension diary matches the Pension Providers requirements.

- Go to Pension Module > Administration > Pension Scheme > Select Scheme > Pension Diary

If the pension diary does not match the Pension Provider. It can be edited.

Fig.1 - The Edit button against Pension Diary

Question/Problem: When downloading the NEST Contribution File/New Starter File in Pensions, the dates are switching.

Answer: Excel will always assume the user is in the USA and therefore changes the date format accordingly when the NEST Contribution File/New Starter CSV file is opened.

The steps described below are best practice for tackling this issue.

- Go to Pension Module > Reports > Exports > Nest Contribution File/Nest Starter File

- Download report and review data

- If all the data is correct, save the file as ‘Nest Data correct’ for own records/auditing purposes

- Re-run the report in Fourth and save without opening the file

- Upload this file (the one that was not opened) to Nest

If some of the data is not correct in the report, the dates in the file will need to be reformatted manually before uploading to Nest. This will mean that the information held by the pension provider and the information on the Portal will differ. An investigation should be made into why the changes were necessary.

Question/Problem: An Employee has changed pay basis but they are still showing on the report for the previous pay basis.

Answer: If an employee has changed pay basis they will also need to be transferred across pension schemes.

- Click here for a guide on How to Transfer Employee Pension Schemes & Worker Groups

An alert can also be set up in HR to advise that an employee has changed Location or Job Title. This may be an indication that they have moved pay basis.

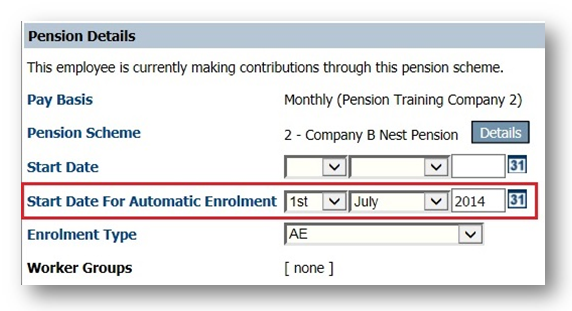

Question/Problem: An employee was transferred from one pension scheme to another but the transfer doesn't seem to have taken effect and instead they now have two records.

Answer: When transferring an employee across pension schemes, a new pension scheme will appear in the employee's pension record. This scheme will need to be set to an AE scheme and a start date entered.

- Go to Pension Module > Employees> Employee List> Search & Select Employee > Employee Pension Info> Pensions> select the active pension record

- Select AE as the Enrolment Type

- Enter a date in Start Date for Automatic Enrolment

- Remove the date from Start Date

- Save changes

Fig.2 - Transferring Pension Schemes

Question/Problem: I am able to see an employee's payslip and can see a deduction has been made. However, when running the export this employee is not included. I have tried to search for the employee in the Pensions module and they are not showing.

Answer: The employee is on the same access level or a higher access level as the person running the report. The employee's payslip can be viewed because there is a setting in the Payroll Module that allows for global visibility.

Question/Problem: An Opt-Out date was entered into an employee's Pension Record and they are due a refund, however this did not appear on their payslip.

Answer: For the refund to be applied in the current pay run, the Opt-Out information must be entered before the payroll cut-off date. If it is entered after the payroll cut-off date, it will appear in the following pay run.

Please note: If a manual adjustment is made for a refund that was entered after the cut-off date, the refund will still appear in the next pay run, resulting in an overpayment.

Comments

Please sign in to leave a comment.