Overview

The Expenses Functionality enables an employee to enter their expenses into the system and for these to be authorised by a line manager. The expense can then be processed by Head Office and paid through the payroll module into the employee’s pay.Expenses Functionality

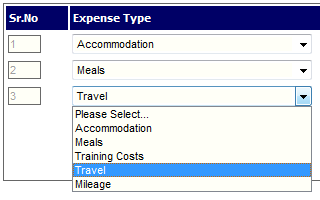

Expense CodesExpense Codes are set up against which the expenses are logged. These are configurable with the VAT rates and the accounting system code if required. The employee builds up their expense submission by creating rows of expenses with the Expense Type, the date, amount and the reason for that expense.

Fig 1 - Expense Types Drop-down List

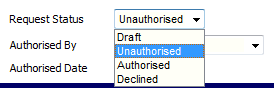

Once the employee has entered their expenses, this can either be saved as a draft and edited before submission, or submitted through for authorisation. This expense is then marked as unauthorised. There is the ability for the employee to print out a report of their expenses on which to attach the receipts if necessary.

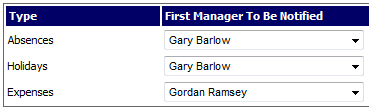

Line Manger Notification

The employee’s line manager will receive an email letting them know there is an expense request that needs authorisation.

Fig 2 - Line Manager Notification Page

Fig 3 - Changing the Request Status

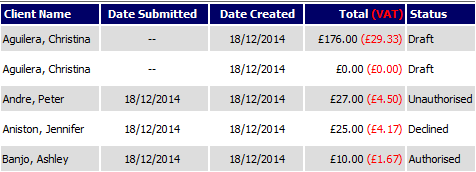

Fig 4 - Employee Expenses Screen

It is very important to have a strong process around expense periods and cut off dates. Expenses that are to be paid through the payroll module will need submitting and authorising before the payroll cut-off date and time. It is advised to communicate these cut offs to the business and advise your Payroll Specialist of the additional configuration.

Comments

Please sign in to leave a comment.