Overview

The Pensions Regulator (TPR) is changing auto-enrolment and qualifying pension schemes for all members from 6th April 2019. This article outlines how these changes affect Fourth’s customers who receive Fourth Bureau Services.

For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

2019 Pension Phasing

From 6th April 2019, The Pensions Regulator (TPR) is increasing the minimum contribution rates for auto-enrolment and qualifying pension schemes for all members.

The new percentage rates outlined below will take affect for any pay date on or after 6th April 2019.

| Date Effective | Employer Minimum Contribution | Employee Contribution | Total Minimum Contribution |

|---|---|---|---|

| Currently until 5th April 2019 | 2% | 3% | 5% |

| 6th April 2019 onwards | 3% | 5% | 8% |

Fourth’s Bureau department have been working to ensure there is minimum disruption to the final phasing increases and have developed an automation that will uplift contribution levels when each customer portal is rolled over to the new tax year.

When each portal is rolled over, the Pension module will perform the following uplifts to ensure schemes are meeting the minimum requirements

| Employer Current % | Employer New % |

|---|---|

| 2% | 3% |

| 3% and over | Remains the same |

| Employee Current % | Employee New % |

|---|---|

| 3% | 5% |

| 4% | 5% |

| 5% and over | Remains the same |

Some organisations may offer a higher employer contribution rate in order to offer additional benefits to their employees. The table below outlines how the automation will deal with Pension scheme where the employer’s pension contribution rate is higher than the minimum rates.

| Employer Current % | Employer New % | Employee Current % | Employee New % |

|---|---|---|---|

| Under 3% | 3% | Under 5% | 5% |

| 4% | 4% | Under 4% | 4% |

| 5% | 5% | Under 3% | 3% |

| 6% | 6% | Under 2% | 2% |

| 7% | 7% | Under 1% | 1% |

| 8% | 8% | 0% | Remains the same |

All changes made will ensure that each scheme is meeting the minimum total contribution requirements of 8%.

The changes will be made automatically to:

- The default percentage rates within the pension scheme

- The default percentage rates within any worker groups

- The percentage rates that are set at employee level

Please note, the changes will be made to both auto-enrolment schemes and those that are not auto-enrolment but are classed as qualifying pension schemes for auto-enrolment purposes (as specified in TPR Guidance).

Fixed Contribution Amounts

The automated changes will not apply to any employees who have fixed amounts set at employee level. Normally, an employee has agreed a fixed amount and so they cannot be updated without further agreement. In order to find out whether any employees are on a fixed amount, a report can be run from the Payroll module.

Please note: AE Managed Service Customers can contact their Payroll Specialist who can provide information about any Fixed Amounts on their payroll.

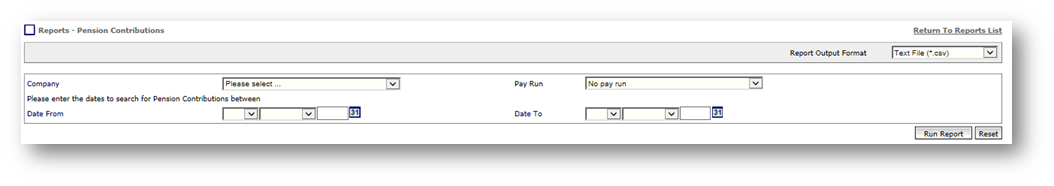

- Go to Payroll > Reports > View Reports > Pension Contributions

Fig.1 – Pensions Contributions Reports page

- Select Company Name

- Select the date range of most recent payroll in Date From and Date To

- Change Report Output Format to ‘Text File (*.csv)’

- Select Run Report

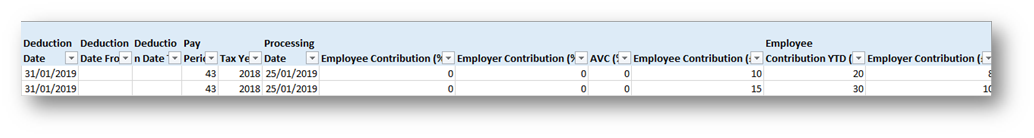

For a list of employees with fixed Employee Contribution amounts:

- Add a Filter to Row 1

- Filter column N to only show 0 values

- Filter column Q and remove 0 values

For a list of employees with fixed Employer Contribution amounts:

- Filter column O to only show 0 values.

- Filter column S and remove 0 amounts

Ensure that the fixed contributions calculate to the minimum contribution amounts (please contact relevant employees if it falls below).

As Employees’ pay can fluctuate quite drastically, it is recommended to change employee fixed accounts to a percentage amount within the employee record.

To update employee’s fixed amounts, send details to the dedicated Payroll Specialist who will ensure the changes are made from the start of the new tax year.

Tier Certification

Some businesses have pension schemes that operate according to tier certification. Fourth’s automated changes will not change rates according to tier certification. For any pay dates from 6th April 2019 onwards, the standard contribution rates are below:

| Tier 1 Certification (Basic Pay) | Tier 2 Certification (Pensionable earnings = at least 85% of total pay) | Tier 3 Certification (Every pay element in an employee’s payroll) |

|---|---|---|

|

|

|

If any changes are required to the pension scheme’s default percentage rates for business due to tier certification, send details to the dedicated Payroll Specialist who will ensure the changes are made from the start of the new tax year.

Next Steps

For any changes required to the pension scheme or employee percentage rates that are different to the guidelines above, contact the dedication Fourth Payroll Specialist with details before 20th March 2019 to ensure any updates are made in time for the first payroll from 6th April 2019. Please contact Fourth’s Bureau department if there are any further questions.

Comments

Please sign in to leave a comment.