Overview

This process will need to be followed if an employee who has been auto-enrolled into a Pension Scheme wishes to leave the Scheme within the first 30 days. If an employee opts out in this period, any contributions will be refunded.

Please Note: If an employee wishes to leave a Pension Scheme after this point, the scheme must be ended via cease membership. This would not be considered as an ‘opt out’ and any contributions would not be refunded.

For all Pensions related articles, please see WFM UK - Pensions: Article Contents Page.

Opting Out an Employee

To opt an employee out of a Scheme, enter the Pension Record for the relevant employee.

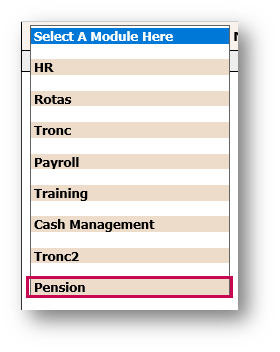

- Go to the Pension module

Fig.1 – Pension Module

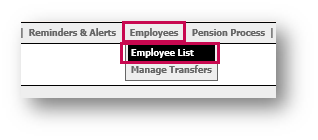

- Select Employee List in the Employee drop-down menu

Fig.2 – Employee List in Employees Drop-Down

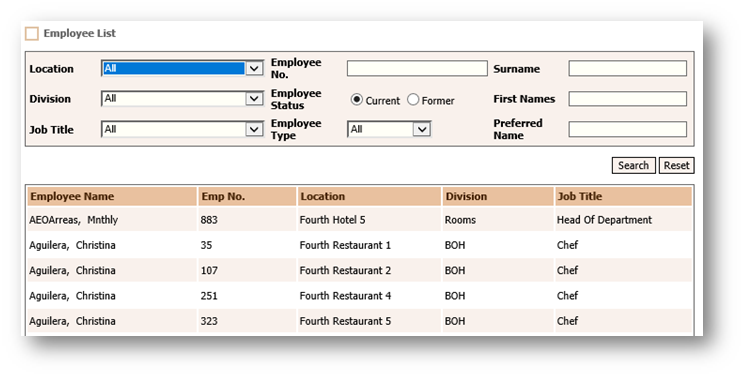

- Select the required Employee

Fig.3 – Employee List

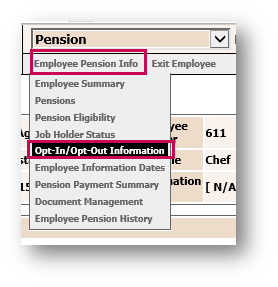

- Select Opt-In/Opt-Out Information in the Employee Pension Info drop-down menu

Fig.4 – Opt-In/Opt-Out Information

-

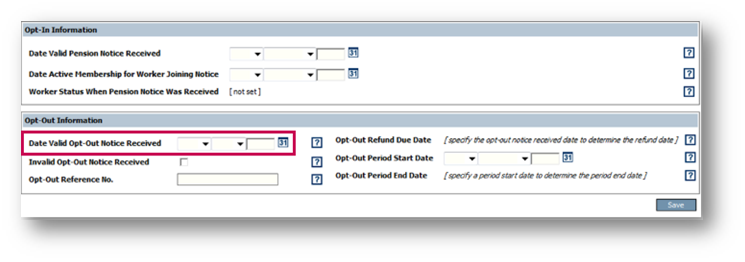

Enter the actual date that the opt out request was received from the employee in the Date Valid Opt Out Notice Received section

Fig.5 – Date Valid Opt-Out Notice Received

-

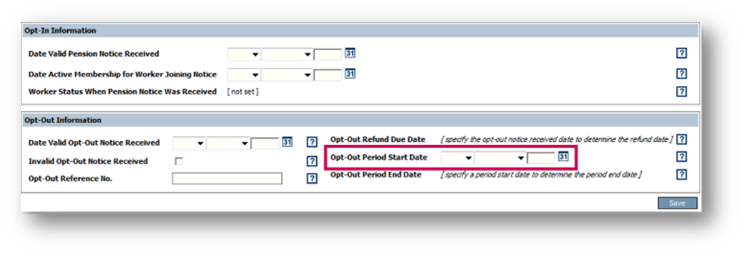

Enter the required date for the Opt-Out Period Start Date

This date is the start of the 30 day opt out period for the Employee.

The date that should be entered here is the date that the Pension Provider is notified of the employee being opted out of a Pension Scheme plus 3 days. For example, if the Pension Provider is notified of the ‘Opt Out’ on 1st September, then the 4th September should be entered here.

This is to ensure that the employee has the full 30 days to ‘Opt Out’ of the Pension Scheme.

- Save

Fig.6 – Opt-Out Period Start Date

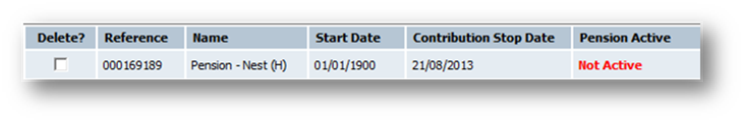

The record will be updated and display as ‘Not Active’ and no further deductions will be made.

In order to show the refund on the Employee’s payslip, the Global Setting ‘Show Negative Payments on Payslip’ must be switched on.

Fig.7 – Not Active Pension Status

Comments

Please sign in to leave a comment.